9th Sustainable Investor Summit (SIS 9) 2026

Join us at three locations across the DACH region: Vienna, Zurich and Frankfurt

Institutional Capital Forum

Institutional Capital Forum

Phoenix Group's Strategy on Nature-Positive Private Markets Solutions

Bruno Gardner, Head of Climate Change and Nature at Phoenix Group talking to Chris Hall, Founding Editor at Sustainable Investor / Sustainable Media Group

investESG

investESG

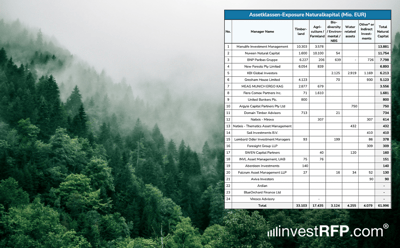

Asset Manager Update und Investment-Strategien bei Natural Capital

Mit Salm Global Land und Van Lanschot Kempen Investment Management zwei weitere etablierte Asset Manager mit Updates

investESG

investESG

Forests Can Be Assets or Liabilities

The world’s forests are premium assets generating priceless benefits. When neglected they can become liabilities.

WRI

WRI

David Carlin's Guide to the Outcomes of COP30

A big failure on fossil fuels, but progress on adaptation, just transition, and forests

investESG

investESG

Investing in the Planet’s Most Valuable Assets

Sowing Seeds of Value Across Natural Capital Managers

investRFP.com – Asset Manager & Fund Selection

investRFP.com – Asset Manager & Fund Selection