Reports

Want to publish your report on ESG.Guide?

Filter by Tags

Filter by Publisher

Responsible Alpha (32)

Responsible Alpha (32)

CFA Institute (12)

CFA Institute (12)

ShareAction (9)

ShareAction (9)

MEAG - MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH (8)

MEAG - MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH (8)

ESG Research (7)

ESG Research (7)

CBI - Climate Bonds Initiative (6)

CBI - Climate Bonds Initiative (6)

Candriam (6)

Candriam (6)

FNG - Forum Nachhaltige Geldanlagen (5)

FNG - Forum Nachhaltige Geldanlagen (5)

Anthos Fund & Asset Management (5)

Anthos Fund & Asset Management (5)

PRI - Principles for Responsible Investment (5)

PRI - Principles for Responsible Investment (5)

Finance for Biodiversity Foundation (5)

Finance for Biodiversity Foundation (5)

CPI - Climate Policy Initiative (5)

CPI - Climate Policy Initiative (5)

Eurosif (5)

Eurosif (5)

The EDHEC Climate Institute (5)

The EDHEC Climate Institute (5)

NZAOA - Net Zero Asset Owner Alliance (4)

NZAOA - Net Zero Asset Owner Alliance (4)

OeBFA - Austrian Treasury (4)

OeBFA - Austrian Treasury (4)

NZAMi - Net Zero Asset Managers initiative (3)

NZAMi - Net Zero Asset Managers initiative (3)

Capital Group (3)

Capital Group (3)

Metzler Asset Management (3)

Metzler Asset Management (3)

NZBAG - Net Zero Banking Alliance Germany (3)

NZBAG - Net Zero Banking Alliance Germany (3)

Morningstar Sustainalytics (3)

Morningstar Sustainalytics (3)

ET.Group (3)

ET.Group (3)

Amova Asset Management Europe Ltd. (3)

Amova Asset Management Europe Ltd. (3)

CDP - Carbon Disclosure Project (2)

CDP - Carbon Disclosure Project (2)

GSIA - Global Sustainable Investment Alliance (2)

GSIA - Global Sustainable Investment Alliance (2)

Ellen MacArthur Foundation (2)

Ellen MacArthur Foundation (2)

IFRS - International Financial Reporting Standards Foundation (2)

IFRS - International Financial Reporting Standards Foundation (2)

UNFCCC - United Nations Framework Convention on Climate Change (2)

UNFCCC - United Nations Framework Convention on Climate Change (2)

UN Women (2)

UN Women (2)

WBA - World Benchmarking Alliance (2)

WBA - World Benchmarking Alliance (2)

WRI - World Resources Institute (2)

WRI - World Resources Institute (2)

WEF - World Economic Forum (2)

WEF - World Economic Forum (2)

Capitals Coalition (2)

Capitals Coalition (2)

Finreon (2)

Finreon (2)

Morningstar (2)

Morningstar (2)

Just Share (2)

Just Share (2)

Climate Arc (2)

Climate Arc (2)

EIB - European Investment Bank (2)

EIB - European Investment Bank (2)

respACT (2)

respACT (2)

Raiffeisen Research (2)

Raiffeisen Research (2)

rfu research GmbH (2)

rfu research GmbH (2)

Sustainable Finance Cluster e. V. (2)

Sustainable Finance Cluster e. V. (2)

ASIP - Schweizerischer Pensionskassenverband (2)

ASIP - Schweizerischer Pensionskassenverband (2)

Pictet Asset Management (1)

Pictet Asset Management (1)

investESG (1)

investESG (1)

ICGN - International Corporate Governance Network (1)

ICGN - International Corporate Governance Network (1)

GRI - Global Reporting Initiative (1)

GRI - Global Reporting Initiative (1)

ICMA - International Capital Markets Association (1)

ICMA - International Capital Markets Association (1)

SSF - Swiss Sustainable Finance (1)

SSF - Swiss Sustainable Finance (1)

IIGCC - The Institutional Investors Group on Climate Change (1)

IIGCC - The Institutional Investors Group on Climate Change (1)

Climate Action 100+ (1)

Climate Action 100+ (1)

ISFC - International Sustainable Finance Centre (1)

ISFC - International Sustainable Finance Centre (1)

Nature Finance (1)

Nature Finance (1)

Taskforce on Nature-related Financial Disclosures (TNFD) (1)

Taskforce on Nature-related Financial Disclosures (TNFD) (1)

NGFS - The Network for Greening the Financial System (1)

NGFS - The Network for Greening the Financial System (1)

CCSI - Columbia Center on Sustainable Investment (1)

CCSI - Columbia Center on Sustainable Investment (1)

Finance for Peace (1)

Finance for Peace (1)

PLSA - Pensions and Lifetime Savings Association (1)

PLSA - Pensions and Lifetime Savings Association (1)

Janus Henderson Investors (1)

Janus Henderson Investors (1)

VBV Betriebliche Altersvorsorge (1)

VBV Betriebliche Altersvorsorge (1)

ITF - Impact Task Force (1)

ITF - Impact Task Force (1)

OPSWF - One Planet Sovereign Wealth Fund Network (1)

OPSWF - One Planet Sovereign Wealth Fund Network (1)

Legal & General Investment Management (1)

Legal & General Investment Management (1)

Security Kapitalanlage AG (1)

Security Kapitalanlage AG (1)

Allianz SE (1)

Allianz SE (1)

Gutmann - Bank Gutmann AG (1)

Gutmann - Bank Gutmann AG (1)

Blue Climate Initiative (1)

Blue Climate Initiative (1)

Border to Coast Pensions Partnership (1)

Border to Coast Pensions Partnership (1)

G&A - Governance & Accountability Institute Inc. (1)

G&A - Governance & Accountability Institute Inc. (1)

Summit of the Future (1)

Summit of the Future (1)

ACT - City Hive (1)

ACT - City Hive (1)

SFAC - Sustainable Finance Action Council (1)

SFAC - Sustainable Finance Action Council (1)

WWF - World Wide Fund for Nature (1)

WWF - World Wide Fund for Nature (1)

MIT Sloan School of Managmeent (1)

MIT Sloan School of Managmeent (1)

Stockholm Resilience Center (1)

Stockholm Resilience Center (1)

Lucerne School of Business - Institute of Financial Services Zug IFZ (1)

Lucerne School of Business - Institute of Financial Services Zug IFZ (1)

ARIC - Adaptation and Resilience Investors Collaborative (1)

ARIC - Adaptation and Resilience Investors Collaborative (1)

Franklin Templeton Institute (1)

Franklin Templeton Institute (1)

BAI - Bundesverband Alternative Investments e.V. (1)

BAI - Bundesverband Alternative Investments e.V. (1)

AXA Investment Managers (1)

AXA Investment Managers (1)

OeEB - Oesterreichische Entwicklungsbank AG (1)

OeEB - Oesterreichische Entwicklungsbank AG (1)

PSF - EU Platform on Sustainable Finance (1)

PSF - EU Platform on Sustainable Finance (1)

IQEQ (1)

IQEQ (1)

Supercritical Tech Ltd. (1)

Supercritical Tech Ltd. (1)

gategroup (1)

gategroup (1)

ZEPCON - Nachhaltige Finanzen (1)

ZEPCON - Nachhaltige Finanzen (1)

The Generation Forest (1)

The Generation Forest (1)

RIBI - Responsible Investment Brand Index (1)

RIBI - Responsible Investment Brand Index (1)

Österreichische Post AG (1)

Österreichische Post AG (1)

Finnfund (1)

Finnfund (1)

Forvis Mazars (1)

Forvis Mazars (1)

RBI - Raiffeisen Bank International (1)

RBI - Raiffeisen Bank International (1)

RIF - Refugee Investment Facility (1)

RIF - Refugee Investment Facility (1)

CPI Europea AG (1)

CPI Europea AG (1)

CA Immobilien Anlagen AG (1)

CA Immobilien Anlagen AG (1)

iGravity Investment Solutions (1)

iGravity Investment Solutions (1)

Bajaj Auto Limited (1)

Bajaj Auto Limited (1)

Joint SDG Fund (1)

Joint SDG Fund (1)

BVI Bundesverband Investment und Asset Management e.V. (1)

BVI Bundesverband Investment und Asset Management e.V. (1)

CCCA - Climate Change Centre Austria (1)

CCCA - Climate Change Centre Austria (1)

BAFTA albert (1)

BAFTA albert (1)

FCLT Global (1)

FCLT Global (1)

EIOPA (1)

EIOPA (1)

CFA Society Germany (1)

CFA Society Germany (1)

Aberdeen Investments (1)

Aberdeen Investments (1)

ASN Impact Investors (1)

ASN Impact Investors (1)

Carmignac Gestion (1)

Carmignac Gestion (1)

KKR & Co. Inc. (1)

KKR & Co. Inc. (1)

British Columbia Investment Management Corporation (1)

British Columbia Investment Management Corporation (1)

LSEG (1)

LSEG (1)

Filter by Publication Date

Filter by Organisation Type

17 reports found.

Retrieving information...

Republic of Austria - Investor Information 2026

Economic & Fiscal Overview - Debt Management - Green Issuance

A new chapter for sustainable fixed income

Why today’s yield environment strengthens the case for sustainable bonds

Sustainable Investing

The Amova Asset Management Sustainable Fixed Income Guide

Basel Principles on Climate-Related Financial Risks: Reserve Bank of India

Macroprudential and Microprudential Perspectives on Implementing the Basel Principles on Climate-Related Financial Risks: Considerations for the Reserve Bank of India

Sustainable Debt Global State of the Market Q1 2025

Cumulative aligned sustainability volume broke through the USD1tn mark in Q1, reaching USD1.1tn.

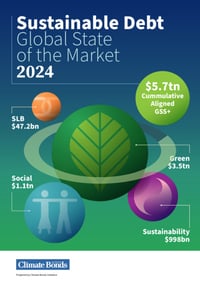

Sustainable Debt Global State of the Market 2024

Green Bonds, Social Bonds, Sustainability Bonds, Socially-Linked Bonds

The Green Deal (EN) #responsiblebanking

Update on the ESG primary and secondary market - Omnibus - Deals of the month - ESG developments

A green financial system can power sustainable economic growth.

The UK’s net zero economy grew by 9% last year

Swiss Sustainable Investment Market Study 2024

Overview of sustainability-related investments in Switzerland and development of sustainability-related investment volumes

Green Investor Report 2023

Second Green Investor Report of the Republic of Austria, published in accordance with the commitments under the Green Framework

Investment and Governance: Through the Lens of Sustainability

Jitendra Aswani and Roberto Rigobon

CHINA SUSTAINABLE DEBT STATE OF THE MARKET REPORT 2023

Published jointly by the Climate Bonds Initiative, and CIB Economic Research and Consulting (CIB Research)

Transition in Action Agri-Food

Prepared by the Climate Bonds Initiative

Investor Sentiment Towards the Green Bond Market in Latin America and the Caribbean

This study explores investor sentiment towards the growing green bond market in Latin America and the Caribbean (LAC). From our survey results of institutional investors, we find institutional investors are interested in increasing their investment exposure to green bonds from the LAC region focused on funding both Nationally Determined Contributions and other green activities dependent on transparency of Use of Proceeds and data in the primary and secondary markets. These findings shed light on the current state of investor sentiment and highlight risks and opportunities pertinent LAC regional issuers, development banks, regulators, and civil society, and both LAC regional and global institutional investors. Addressing these risks and opportunities could potentially improve investor confidence and encourage greater participation in green finance, which could promote sustainable development not only in Latin America and the Caribbean, but also globally.

Landscape of Guarantees for Climate Finance in EMDEs

52 different cross-border guarantee instruments from 34 key entities

Green Investor Report 2022

First Green Investor Report of the Republic of Austria, published in accordance with the commitments under the Green Framework