Sowing Seeds of Value Across Natural Capital Managers

Photo credit: investRFP.com

Fact Findings on the Current Landscape of Natural Capital Managers | November 2025

The asset class of natural capital is gaining momentum as investor demand continues to rise. In parallel, the universe of asset managers active in this space has expanded considerably. Many established managers are broadening both their geographic coverage and the breadth of their investment offerings.

Against this backdrop, in November 2025, investRFP conducted a survey of natural capital managers to assess their sustainability approaches, investment opportunities, and expected return levels from an investor’s perspective.

What Constitutes Natural Capital Investments?

Natural capital encompasses the natural resources, ecosystems, and environmental services essential for human life and the global economy such as agricultural land, water, forests, and biodiversity.

Natural capital investments refer to the allocation of capital into these resources and ecosystems with the goal of protecting ecological systems, mitigating climate impacts, and generating sustainable economic returns. The primary emphasis of these investments lies in sustainable agricultural use.

Categories of Natural Capital Investments

Environmentally focused natural capital strategies typically fall into three core areas:

- Regenerative agriculture

- Sustainable forestry

- Ecosystem restoration, often implemented through: CO₂ sequestration Irrigation and rehabilitation of arid land and Biodiversity enhancement

Why Natural Capital Matters for Institutional Investors

For institutional investors, natural capital offers several compelling investment arguments.

Portfolio Advantages

- Strong diversification benefits due to low correlation with traditional asset classes such as equities and bonds

- Long-term, stable cash flows

- Inflation protection, driven by real asset exposure and recurring revenues from agricultural output or timber production

Macro Drivers

With global land resources limited and resource demand rising, natural capital assets stand to benefit from structural value appreciation over time.

Operational and Revenue Opportunities

Larger asset management firms may achieve:

- Economies of scale in operational management

- Additional income streams, including: CO₂ certificate generation

- Land use for solar or wind energy installations

Key Considerations and Risks

- The asset class is best suited for long-term investor horizons

- Its value is subject to market fluctuations

- Underlying assets are highly illiquid

These characteristics underline the importance of selecting an experienced asset manager with proven expertise, market reach, and a well-defined business approach to natural capital.

Current Landscape of Natural Capital Managers

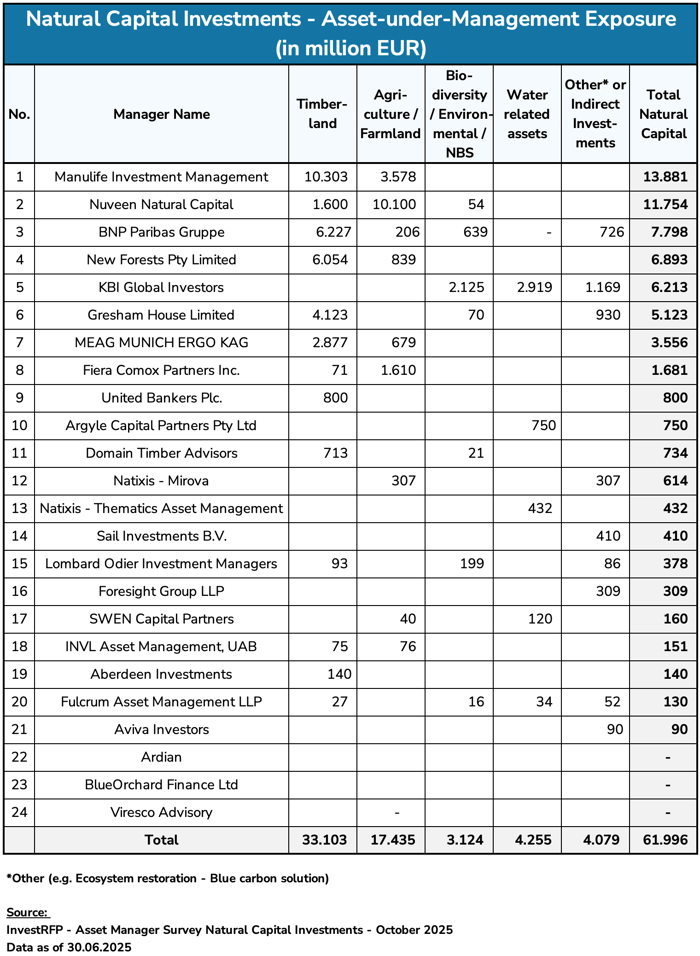

The asset managers surveyed in November 2025 by investRFP are listed according to their volume of natural capital assets under management. Managers without disclosed exposure figures are nonetheless established players offering innovative investment concepts within the asset class.

In addition to direct investments in agricultural or forestry land, investors can also achieve sustainability impact and SFDR Article 9 alignment through indirect investments, such as:

- Private debt

- Private equity

- Listed equity in companies engaged in natural capital activities

Conclusion and Further Insights

Because investment strategies differ significantly among managers, we refer readers to our analysis, which includes information on expected returns for each investment offering.

Author: Hubert Langer

Published by

investRFP.com – Asset Manager & Fund Selection

investRFP.com – Asset Manager & Fund Selection

investRFP.com – Asset Manager & Fund Selection

investRFP.com – Asset Manager & Fund Selection