Why today’s yield environment strengthens the case for sustainable bonds

Photo credit: Amova Asset Management

Steve Williams, EMEA Head of Global Fixed Income

A window of opportunity for long-term investors

The case for fixed income is back, and this time, it’s different. After years of historically low interest rates and stretched valuations across risk assets, global yields have returned to levels not seen in nearly two decades. For income-seeking investors, this presents a rare window: bond yields today offer more than just stability. They create the potential for meaningful total returns over the medium term, especially as the macro environment begins to shift.

With most developed markets now at or near peak rates, we believe the window to lock in attractive yields may be shortlived. As central banks begin to cut rates in response to slowing inflation and economic softening, the traditional inverse relationship between price and yield should begin to favour capital appreciation over the coming years, making the case for increasing fixed income exposure now even more appealing.

At the same time, sustainable bonds have matured as an asset class, moving beyond the early days of green premiums and limited availability. Investors can now access welldiversified, high-quality sustainable bond portfolios without compromising on return expectations.

Green bonds are growing up

The idea that sustainable fixed income lags behind traditional bonds on yield or performance no longer holds. The so-called “greenium”, the premium investors once expected to pay for labelled bonds, has largely disappeared. In most developed markets, yield differences have narrowed to just a handful of basis points, with far greater impact now coming from factors such as duration, currency risk or credit quality.

Today, the green bond market stands at over US dollar (USD) 5 trillion in cumulative issuance and continues to grow. Forecasts suggest that labelled bond issuance could again surpass USD 1 trillion in 2025, with a growing share coming from sovereigns, supranational institutions and corporates, particularly in Europe.

This expansion isn’t just about volume. It also reflects the increasing sophistication of issuers and investors alike. For example, green bonds now cover a wider range of projects, from renewable energy to clean transportation and green buildings. For institutional investors, this brings greater diversification and more opportunities to align portfolios with long-term climate objectives, without sacrificing financial discipline.

Japan’s pension funds tilt toward ESG

In a move that could reshape regional dynamics, several of Japan’s largest public pension funds have signed the UNbacked Principles for Responsible Investment (PRI) this year. Together, these funds oversee more than Japanese yen (JPY) 90 trillion (USD 566 billion) in assets, with recent signatories including funds managing retirement savings for police and public school employees.

This builds on earlier ESG commitments by the Government Pension Investment Fund (GPIF), one of the world’s largest asset owners. With support from political leaders, including former Prime Minister Fumio Kishida, the momentum behind ESG in Japan is now reaching new levels. The government’s Green Transformation (GX) programme—including the launch of transition bonds in 2024—is targeting JPY 150 trillion in sustainable investment over the next decade. If realised, this could provide a major boost to sustainable capital markets in Asia and beyond.

Delivering real-world outcomes through fixed income

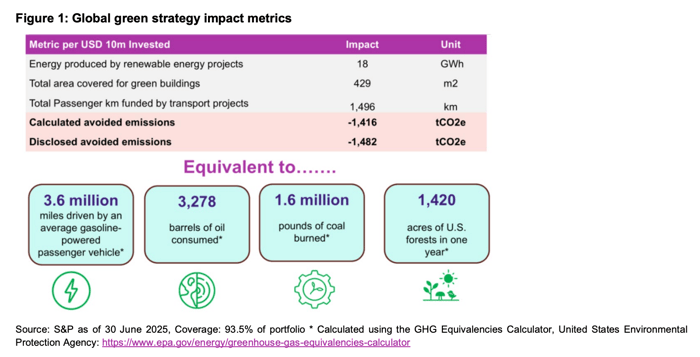

Unlike some asset classes where sustainability claims can be harder to verify, green bonds are inherently linked to tangible outcomes. Each labelled bond is typically aligned with a use-of-proceeds framework and subject to external verification.

That transparency helps investors understand and measure their impact.

For example, every USD 10 million invested in Amova’s global green bond strategy supports the generation of 18GWh of renewable energy and helps avoid an estimated 1,400 tonnes of CO₂-equivalent emissions annually. To put that in context, that’s roughly equal to taking 3.6 million car miles off the road or avoiding the combustion of more than 3,200 barrels of oil.

These metrics aren’t abstract. They provide investors with a concrete understanding of how their capital contributes to climate solutions, alongside a stable stream of income.

We believe 2025 may be remembered as the turning point, not only for fixed income as an asset class, but for the role of sustainable bonds within long-term portfolios. As the macro environment evolves, the ability to combine yield, stability and impact becomes increasingly valuable. Sustainable fixed income is no longer a niche or specialist strategy, but is a core allocation for investors looking to balance long-term performance with measurable environmental benefits.

To learn more about sustainable fixed income investing, read Amova Asset Management’s investment guide here.

By Steve Williams, EMEA Head of Global Fixed Income

Steve Williams is the Head of EMEA Global Fixed Income and a Managing Director in Amova Asset Management’s London office. He is a member of the fixed income and foreign exchange investment committee as well as the portfolio manager with oversight for the firm’s investment grade, municipal, global green bond, global mortgages and global bond business.

He joined Amova AM in 2007 and took over co-management responsibility for the firm’s flagship global sovereign bond strategy as well as launching the first dedicated Danish mortgage bond strategy into Japan in 2016 and has managed Amova’s Global Green Bond strategy since 2015.

Steve, previously served as a Credit research analyst with New York Life Investment Management in corporate bonds and structured finance as a senior analyst. He has over 20 years of investment experience and holds an MBA from Duke University’s Fuqua School of Business. He received his undergraduate degree from the University of Michigan and is a certified FRM.

Published by

Amova Asset Management Europe Ltd.

Amova Asset Management Europe Ltd.

Amova Asset Management Europe Ltd.

Amova Asset Management Europe Ltd.