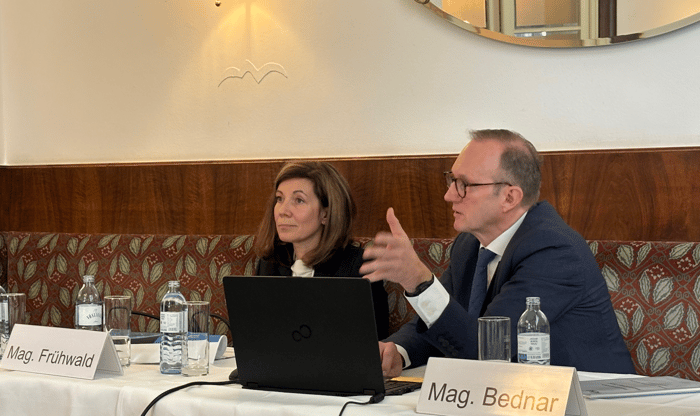

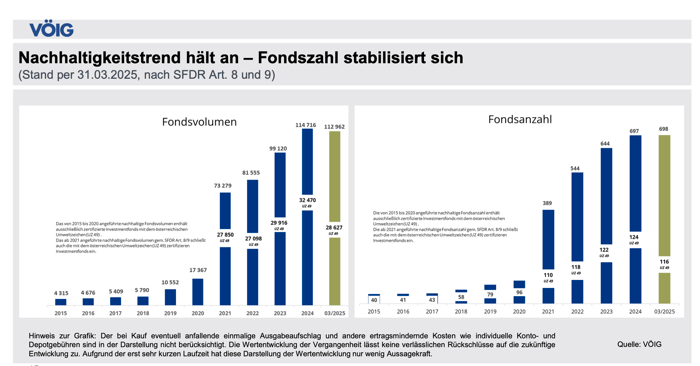

Total Austrian fund assets at €217,5 bn (31 March 2025) - ESG funds accounting for 52 percent of assets (€113 bn) and 40 percent of net inflows (€392,8).

Photo credit: ESG.Guide

Anita Frühwald, Board Member VAIÖ - Heinz Bednar, President VÖIG

"The Austrian investment fund market experienced a high level of interest from retail and institutional investors over the past year 2024 and in Q1/2025 due to positive performance in most asset classes" as presented by Heinz Bender, president of VÖIG (Vereinigung Österreichischer Investmentgesellschaften) representing the domestic fund industry.

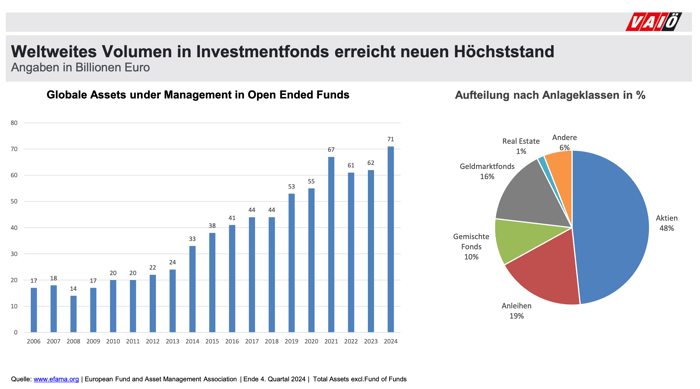

Global fund assets grew to a record level of € 71 trillion in open-ended fund assets based on EFAMA statistics as per end of 2024. The year-on-year growth rate of 14 percent demonstrated healthy demand in global markets. "The global fund industry shows impressive growth but also faces margin pressures and higher costs in a challenging geo-political environment", as outlined by Anita Frühwald, board member of VAIÖ (Vereinigung Ausländischer Investmentgesellschaften in Österreich) representing international asset managers on the Austrian market.

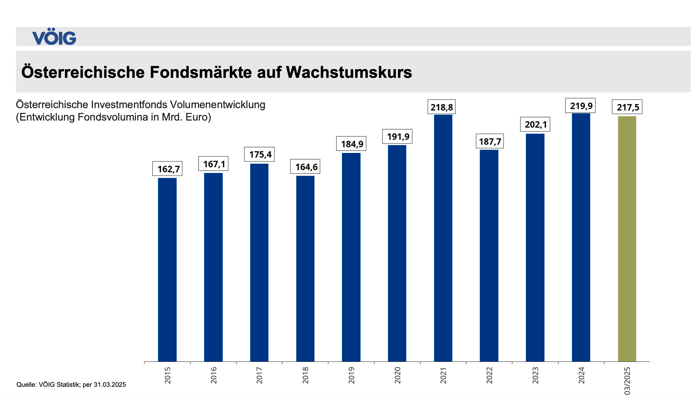

Positive net inflows at near record total assets level

Total assets in the Austrian fund market (funds domiciled in Austria) as per 31 March, 2025 were at €217,5 bn (-1,1 percent vs. Dec 2024). Net inflows in Q1/2025 were positive (€980 million).

Balanced funds accounted for 47,4 percent, representing the largest category on the domestic market. The share of balanced funds has been rather stable over the past ten years increasing from 41,7 percent in 2015 to 47,4 percent currently. The share of equity funds increased from 14,6 percent to 21,3 percent and bond funds decreased from 43,5 percent to 31,2 percent over the same period.

Net inflows in Q1/2025 were positive at €980,13 but it is worth noting that the bulk of these net inflows were recorded in January 2025. The split between retail and institutional funds was strongly tilted towards institutional investors with Spezialfonds representing 41,3 percent and pure retail funds accounting for only 10 percent after experiencing outflows of €239,56 million in March 2025.

ESG investment funds with net inflows

Austrian domiciled ESG funds (article 8 and 9 SFDR) showed net inflows of €392,8 million. Total ESG assets decreased slightly from €114,7 bn to €113 bn over the first quarter of 2025. The number of funds remained high at 698 (vs. 697 at year-end 2024).

"In the Austrian ESG fund segment we saw a shift from Art. 9 funds to Art. 8 funds. The overall level of demand and interest from clients remains high", explained Heinz Bednar. He also referred to selective rebalancing in funds with higher small cap and tech allocations. The asset management industry is challenged by changing EU regulation, fund name rules, classification issues and other uncertainties that contribute to the overall cost increases in the ESG fund segment.

Global fund assets at record levels

The latest available fund statistics from EFAMA as per end of 2024 show that global fund assets were at a record level of €71 trillion, equity funds representing 48 percent, bond funds 19 percent, balanced funds 10 percent, money market funds 16 percent, real estate funds at 1 percent and other categories at 6 percent.

Strong growth in assets in 2024 was recorded in the USA, +22 percent to €40,7 trillion, in Europe, +13 percent to €22,7 trillion and in relative terms in India with the highest percentage growth of 37 percent to €0,7 trillion.

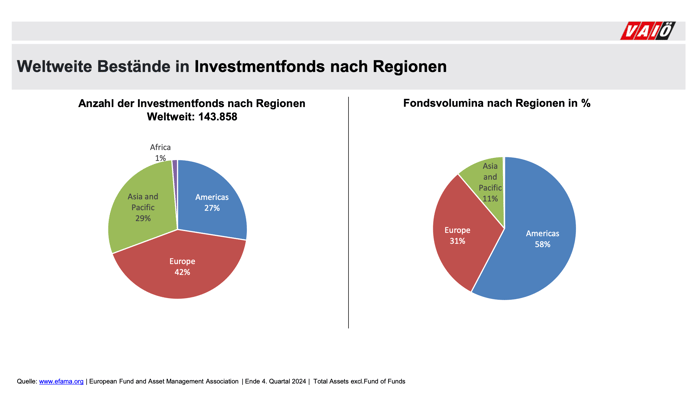

Smaller fund sizes in Europe

Europe accounts for the largest number of funds (60.400 funds or 42 percent) but only 31 percent of assets. The average fund size in Europe is €375 million, compared to €1 bn in the USA. Consolidation in Europe will continue which will result in company and fund mergers over time.

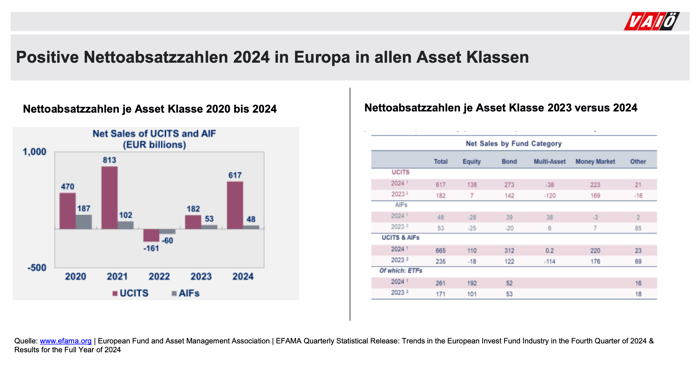

ETF growth in Europe - no ETF provider in Austria

Over the past year the ETF segment experienced strong growth rates. ETF net sales in 2024 (€261 bn) accounted for 40 percent of net sales in Europe (€665 bn). Further growth is expected over the next few years. "The introduction of active ETFs contributed to the overall growth rate", commented Anita Frühwald representing the association of international asset managers in Austria who provide a number of ETF products to investors in Austria. Currently there is no domestic asset manager providing ETF products on the Austrian marketplace.

Fund market trends and policies

As part of the presentation of VÖIG and VAIÖ a number of trends and developments on the fund and asset management market were presented and discussed, including a bi-annual study conducted by INTEGRAL on the investor sentiment trends, financial literacy, tax policies and investor preferences for asset classes.

Most of the results presented in the 2024 study were in line with previous studies with respect to important factors influencing the preference for investment funds and investing in general (level of income and education, age, gender, etc.). Demographic trends will continue to support current trends over the next few years.

A change in government policy with respect to taxation and the development of a funded pension scheme could change the asset management landscape but there are no indications yet that the current coalition government will address the asset management and capital market anytime soon due to challenging budget constraints (4,5 percent deficit and rising public debt levels).

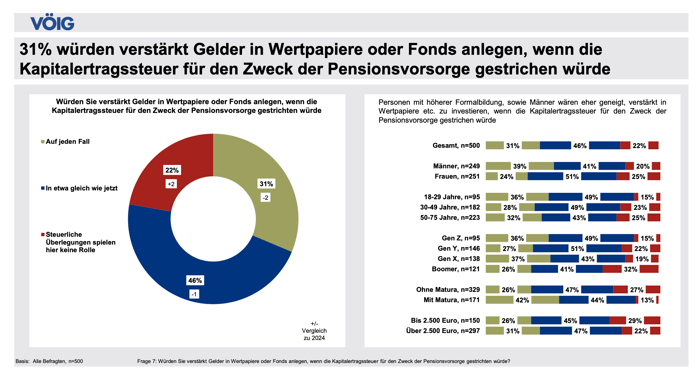

31 percent of respondents to the INTEGRAL study expressed an interest in fund and securities investments in case the capital gains tax would be abolished in specific retirement accounts.

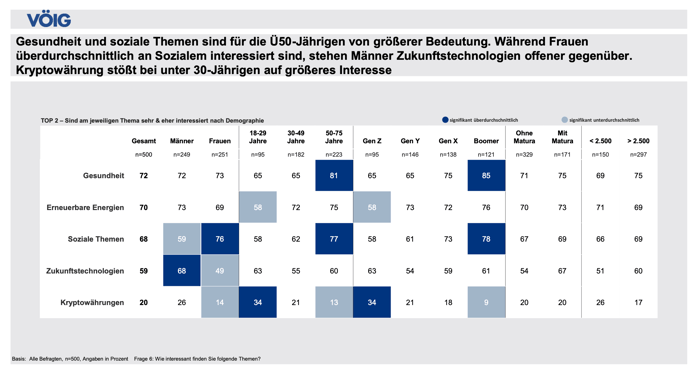

The level of interest in crypto currencies remains very low across all age groups. As expected Gen Z expressed more interest in this new market segment (34 percent) in contrast to Gen Y (21 percent), Gen X (18 percent) and the Boomer (9 percent).

Financial education remains a long-term project - also for schools

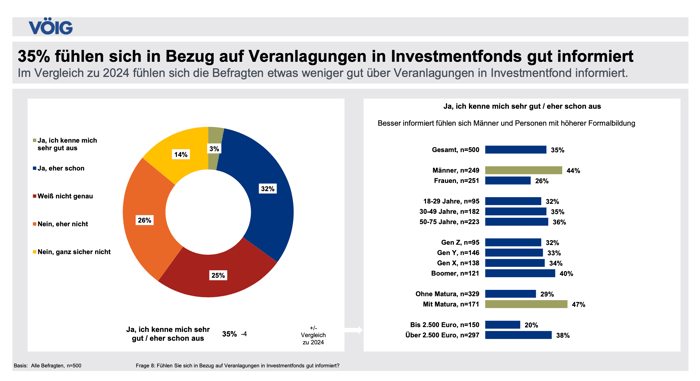

More work has to be done on the financial education side. Only 35 percent of respondents expressed to be rather well informed about fund investments.

14 percent mentioned that they would not know anything about funds. 25 percent were not sure (which can also be interpreted rather negatively) and 26 percent said that they are not really informed.

79 percent of respondents were positive about the idea of teaching financial education in schools at an early age and only 3 percent don't consider this to be important.

This is a strong message that should be heard by policy makers and the fund industry to support future growth opportunities for investors and fund providers.

Published by

investESG

investESG

investESG

investESG