As economies face pressures to adapt pension systems, 2025 Mercer CFA InstituteGlobal Pension Index outlines principles to balance retirees’ needs and national interests.

Photo credit: Thompson Le / Unsplash+

Mercer, a business of Marsh McLennan (NYSE: MMC) and a global leader in helping clients realize their investment objectives, shape the future of work and enhance health and retirement outcomes for their people, and CFA Institute, the global association of investment professionals, today released the 17th annual Mercer CFA Institute Global Pension Index (MCGPI).

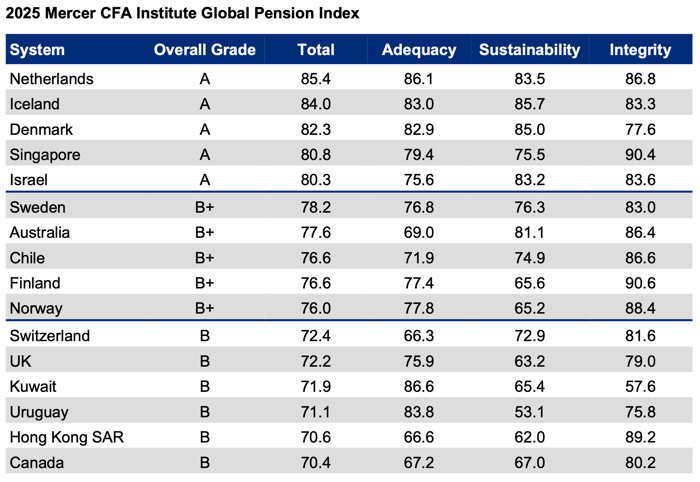

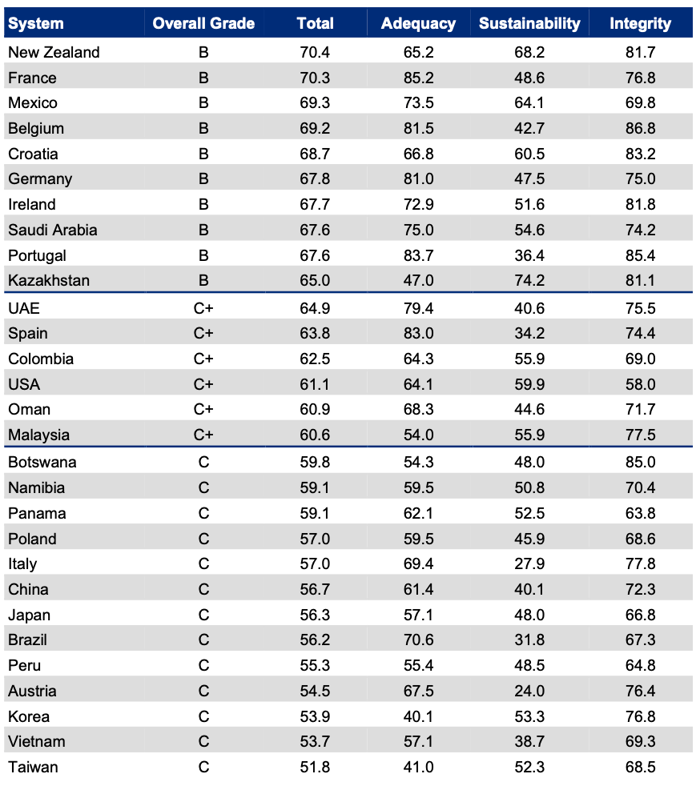

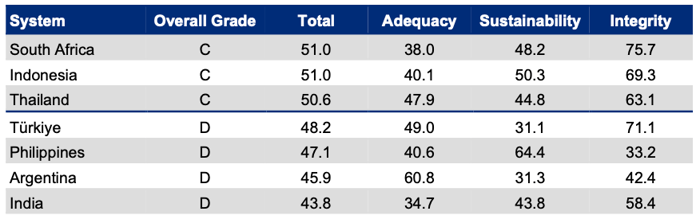

The retirement income systems of the Netherlands, Iceland, Denmark, and Israel retained their A grade in 2025. For the first time, Singapore received an A grade, the only country in Asia to achieve the rating.

Amid rising global uncertainty, the growth and scale of pension fund assets are increasingly prompting governments to look for ways to channel some of this capital into national priorities. This year’s Index explores how government interventions can have unexpected consequences and suggests eight principles for how governments can best balance the interests of private pension plan participants and broader national priorities.

“As people live longer and labor markets shift, governments are facing pressure to adapt pension systems,” commented Christine Mahoney, Mercer’s Global Defined Benefit/Defined Contribution Leader. “However, pension reform is never simple. Assessing possible outcomes is essential, which is why employers, governments, and pension providers should all have a voice in shaping more resilient pension systems.”

Margaret Franklin, CFA, President and CEO, CFA Institute, added: “Regulations and government actions - from tax policies to investment mandates - profoundly shape how pension funds can allocate capital. As some systems look to pension funds to drive investments that are considered in the national interest, the professional investment community must guard against the unintended consequences that may arise when mandates or restrictions distort the system. As the Index makes clear, the central purpose of pensions must remain to secure retirement income, guided by fiduciary duty above all else. Pension systems work best when they balance innovation and national priorities with the enduring responsibility to serve end-investors’ interests.”

Government mandates versus collaboration

Governments worldwide have long played a role in shaping how private pension funds invest, by imposing guidelines to protect retirees or encouraging the pension sector to support domestic economic goals. Countries including the UK, Canada, Australia, and Malaysia have recently encouraged pension funds to support domestic infrastructure and innovation. Meanwhile, in other countries, debates continue around whether pension funds should be forced to consider environmental, social and governance factors instead of focusing solely on financial performance in investment decisions.

“Pension systems with no or limited restrictions tend to perform better in the Index,” commented Tim Jenkins, lead author of the report and Partner at Mercer. “This suggests that instead of imposing mandates, governments can focus on making investment options attractive, promoting transparency and sound governance, and fostering collaboration with the private sector to support sustainable retirement systems and economic growth.”

Retirement income provision improves at a global scale

Countries that achieved Index scores greater than 80 earned an A grade. These countries offer a robust retirement income system that delivers good benefits, is sustainable and has a high level of integrity. The Index uses the weighted average of the sub-indices of adequacy, sustainability and integrity. For each sub-index, the systems with the highest values were Kuwait for adequacy, Iceland for sustainability and Finland for integrity.

Strikingly, eight retirement income systems have improved their Index grade this year, and no systems have been downgraded. This shows that retirement income provision is improving at a global scale - acritically important outcome as people live longer and birth rates continue to decline.

Published by

investESG

investESG

investESG

investESG