New investor guide on the business case and process for managing sustainability-related risks in portco supply chains.

Photo credit: Photo by CHUTTERSNAP on Unsplash

The Principles for Responsible Investment (PRI) has published a report titled Sustainability in supply chains: A guide for private markets investors, which provides guidance for both investors and their portfolio companies on the ‘why’ and ‘how’ of integrating supply chain due diligence to their management practices.

Key messages:

- There is a clear business case for supply chain due diligence.

- Supply chain due diligence can be embedded across all investment stages.

- Mapping out supply chains can uncover hidden risks and opportunities.

- Risks in the supply chain vary across regions and industries and can be mitigated when portfolio companies have mature risk management processes.

- Companies should establish robust supply chain frameworks and processes. These include supply chain mapping, targeted risk assessments and focused due diligence, as well as mitigation measures such as supplier training and continuous performance monitoring.

Why read it:

This is an easy to read and useful tool on a topic that touches a great many companies: large companies because they have vast and complex supply chains where material risks may live; and smaller companies because they are part of those supply chains and therefore likely to be summoned to demonstrate good risk management.

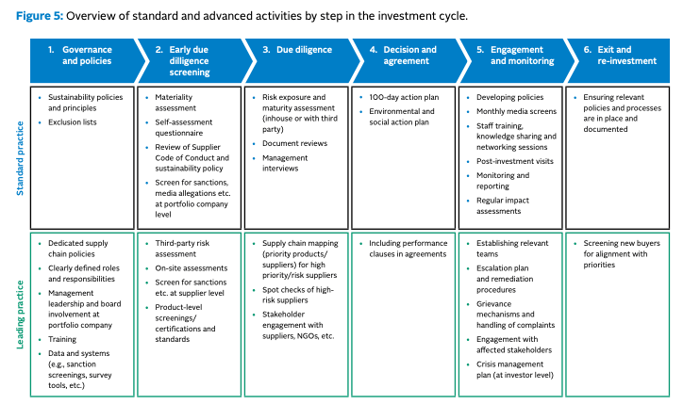

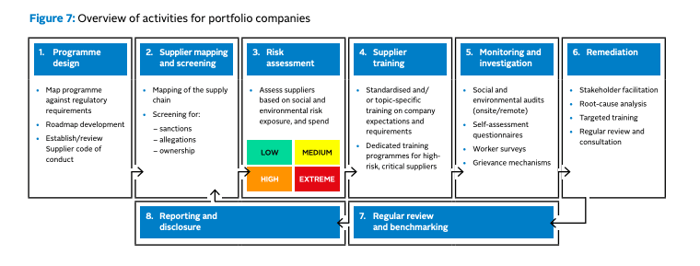

In addition to presenting a compelling – and very risk-centric – ‘business case’ for supply chain due diligence, the document offers a detailed how-to-integrate-it process for investors, and another one for companies.

Steps for investors to integrate a portco supply chain due diligence program

Steps for companies to implement a supply chain due diligence program

There is a rather long list of resources at the back of the document, as well as a useful global supply chain regulation tracker (downloadable Excel tool) and summary of key regulations that the PRI and legal firm Travers Smith have published.

Food for thought:

Investors are an important driver of behaviour change when it comes to integrating sustainability-related impacts, risks, and opportunities. Their influence increases exponentially when their attention expands to supply chains, pulling a large number of smaller companies into the sustainability fold.

Published by

ESG Disclosure Coach

ESG Disclosure Coach

ESG Disclosure Coach

ESG Disclosure Coach