BVI: THE SUSTAINABLE FUND MARKET IN THE FIRST HALF OF 2025

Photo credit: Getty Images / Unsplash+

As a result of adjustments to the ESG target market concept, the sustainable fund market in Germany has changed significantly: Funds with sustainability features are now investing to a much greater extent in companies from the defence sector. Initially, investments in companies that derived more than 10 per cent of their revenues from the production or sale of military hardware were excluded; since December 2024, only investments in manufacturers of weapons banned under international law are prohibited.

This change gives fund providers and investors greater flexibility in light of shifting geopolitical conditions. There are three distinct approaches:

- Some providers continue to categorically exclude investments in the defence industry from their sustainability-featured funds, such as church-affiliated managers.

- Others allow investments in companies where military hardware account for a small share of revenues (e.g., up to 10 per cent).

- In addition, there are providers who, for certain products, forgo exclusions altogether and thus generally permit defence manufacturers as investment targets in funds with sustainability features.

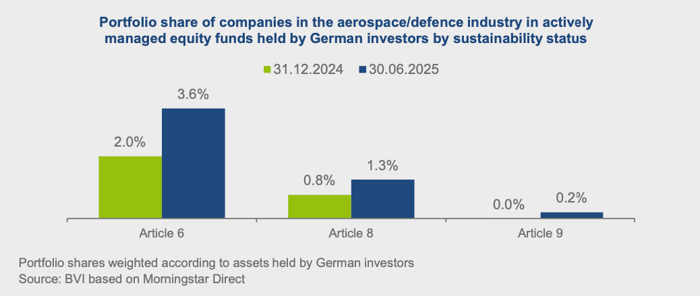

These changes are already evident in portfolios at the end of June 2025. In actively managed equity funds according to Article 8 SFDR, the asset-weighted share of companies from the aerospace and defence sector rose from 0.8 per cent at the end of 2024 to 1.3 percent at mid-year. Particularly noticeable is the increase in products focused on Germany, which can now invest in companies such as Airbus and Rheinmetall and have allocated a portfolio share of 4.6 per cent to the defence industry. Article 9 funds reported, for the first time, a measurable engagement (0.2 per cent).

Funds with sustainability features, however, still invest less in Aerospace & Defence than conventional products (3.6 per cent). Moreover, Article 8/9 funds in other European countries show a somewhat higher portfolio share of just under 2 percent (source: Morningstar for Q1 2025). Given the gradual adjustments, we expect that the share of defence companies in the portfolios of ESG products sold in Germany will continue to rise over the course of the year.

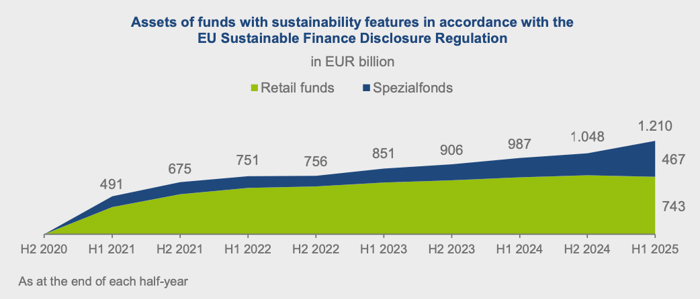

Overall, funds governed by Articles 8 and 9 SFDR managed over EUR 1,200 billion for investors in Germany as of June 30, 2025. Since the beginning of the year, assets under management have increased significantly—mainly due to retrospective reports of re-classified Spezialfonds for institutional clients by a major provider. Spezialfonds with sustainability features now invest more than EUR 460 billion for their clients.

In contrast, the volume of Article 8 and 9 retail funds declined and amounted to just under EUR 750 billion.In terms of new business, the negative trend of previous quarters continued—especially among private investors. While conventional retail funds posted net inflows of almost EUR 50 billion in the first half of 2025, products with sustainability features saw net outflows of EUR 1.3 billion. Spezialfonds investors put more than three times as much new money in Article 6 funds as in Article 8 and 9 funds during the current year.

More information: BVI

Contact: markus.michel@bvi.de, +49 69 15 40 90 242

Published by

investESG

investESG

investESG

investESG