Swedish & European Small-Cap Funds with Sustainability Compliance – Invitation for Asset Managers

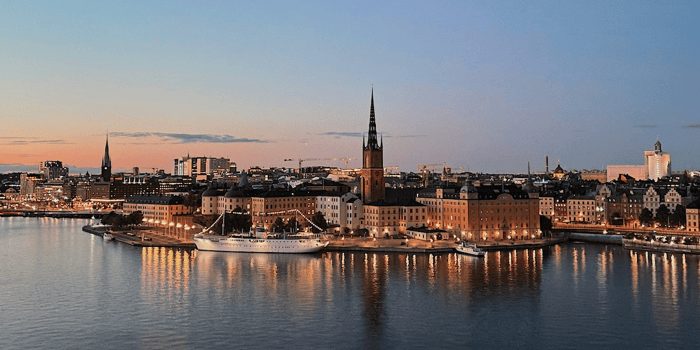

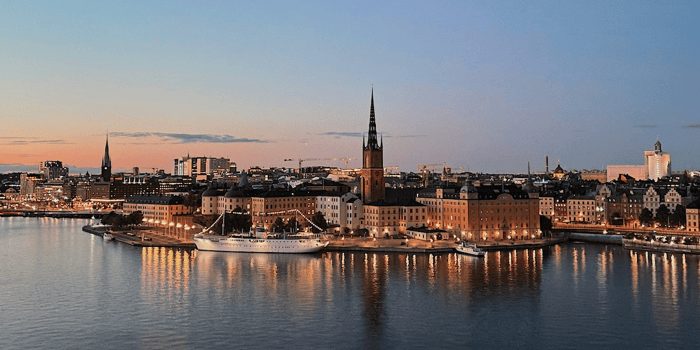

Photo credit: Oscar Nord / Unsplash

The Swedish Fund Selection Agency (FTN) has released preliminary procurement specifications for actively managed Swedish and European small-cap funds. These drafts serve as preparatory documents, providing asset managers an early opportunity to review key requirements and submit questions or comments ahead of the final specifications.

Interested asset managers are encouraged to review the preliminary specifications available through FTN:

- DRAFT Tender Specifications for Actively Managed Swedish Small-Cap Funds

- DRAFT Tender Specifications for Actively Managed European Small-Cap Funds

Key Procurement Requirements

The procurement includes stringent criteria to ensure high-quality actively managed funds. Below are the primary requirements:

Swedish Small-Cap Funds

1. Investment Focus: Actively managed fund targeting global equities, large and mid-cap companies in developed markets.

2. Fund Structure: Must be a UCITS fund, excluding ETFs and self-managing UCITS.

3. Feeder Funds: Not permitted.

4. Share Class: Only accumulating share classes allowed.

5. Trading Currency: Acceptable currencies: SEK, NOK, EUR, or USD.

6. Sustainability Compliance: Must meet SFDR Article 8 or 9 requirements.

7. Investment Objective: Outperform the fund’s benchmark.

8. Benchmark: Must be rules-based, transparent, publicly disclosed, and a relevant market reference.

9. Active Management Criteria: Minimum 2% active risk relative to the benchmark or at least 60% active share relative to the benchmark.

10. FTN’s Category Benchmark: Carnegie Small Cap Index.

11. Investment Restrictions: Investments in other funds are not permitted.

12. Use of Derivatives: Limited to standardized derivatives, including currency forwards (OTC) for transaction management.

13. Securities Lending: Allowed but not required.

14. Trading & Reporting: Daily trading and NAV reporting mandatory.

European Small-Cap Funds

1. Investment Focus: Actively managed fund targeting European small-cap equities.

2. Fund Structure: Must be a UCITS fund, excluding ETFs and self-managing UCITS.

3. Feeder Funds: Not permitted.

4. Share Class: Only accumulating share classes allowed.

5. Trading Currency: Acceptable currencies: SEK, NOK, EUR, or USD.

6. Sustainability Compliance: Must meet SFDR Article 8 or 9 requirements.

7. Investment Objective: Outperform the fund’s benchmark.

8. Benchmark: Must be rules-based, transparent, publicly disclosed, and a relevant market reference.

9. Active Management Criteria: Minimum 2% active risk relative to the benchmark or at least 60% active share relative to the benchmark.

10. FTN’s Category Benchmark: MSCI Europe Small Cap.

11. Investment Restrictions: Investments in other funds are not permitted.

12. Use of Derivatives: Limited to standardized derivatives, including currency forwards (OTC) for transaction management.

13. Securities Lending: Allowed but not required.

14. Trading & Reporting: Daily trading and NAV reporting mandatory.

Next Steps

The final procurement specifications will be published upon formal initiation of the selection process. Asset managers are encouraged to review the draft specifications and provide feedback to FTN in preparation for tender submissions.

To get information about our procurement sign up here Newsletter - Fondtorgsnämnden

Published by

investESG

investESG

investESG

investESG