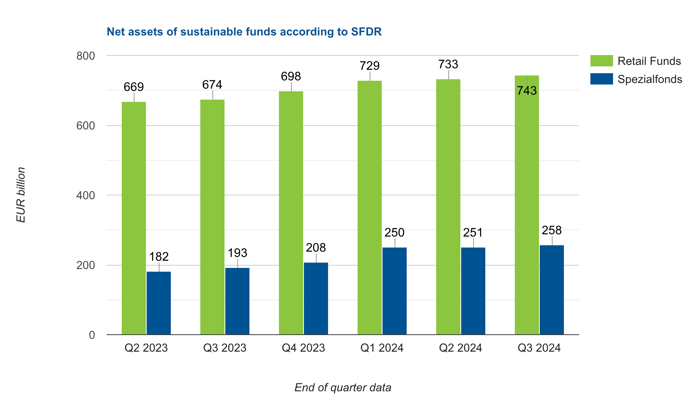

According to BVI, as per end of Q3/2024, private and institutional investors in Germany held over one trillion euros in funds with sustainability features.

Retail funds in accordance with Article 8/9 of the EU Sustainable Finance Disclosure Regulation (SFDR) account for more than three quarters of the assets, with a total of EUR 743 billion.

Spezialfonds with sustainability features make up a smaller part of the market but have grown significantly. In the first nine months of the year, their assets under management increased by 24 percent to EUR 258 billion. The main reason for this was the reclassification of some large products managed for pension institutions. Retail funds saw an increase in assets of around six percent.

The BVI end of quarter analysis also provided information on the challenge of categorising investment funds as "sustainable" and also referred to the new ESMA rule on fund names.

Being categorised as a retail fund in accordance with Article 8 or 9 SFDR alone is not sufficient when advising clients with sustainability preferences. The investment strategy must also meet additional requirements, such as committing to a minimum share of either sustainable investments according to SFDR or of Taxonomy-aligned investments. Also, funds may consider the principal adverse impacts on sustainability (PAIs).

For more information refer to BVI.