INSIGHT by CarbonTracker

© Martin Adams

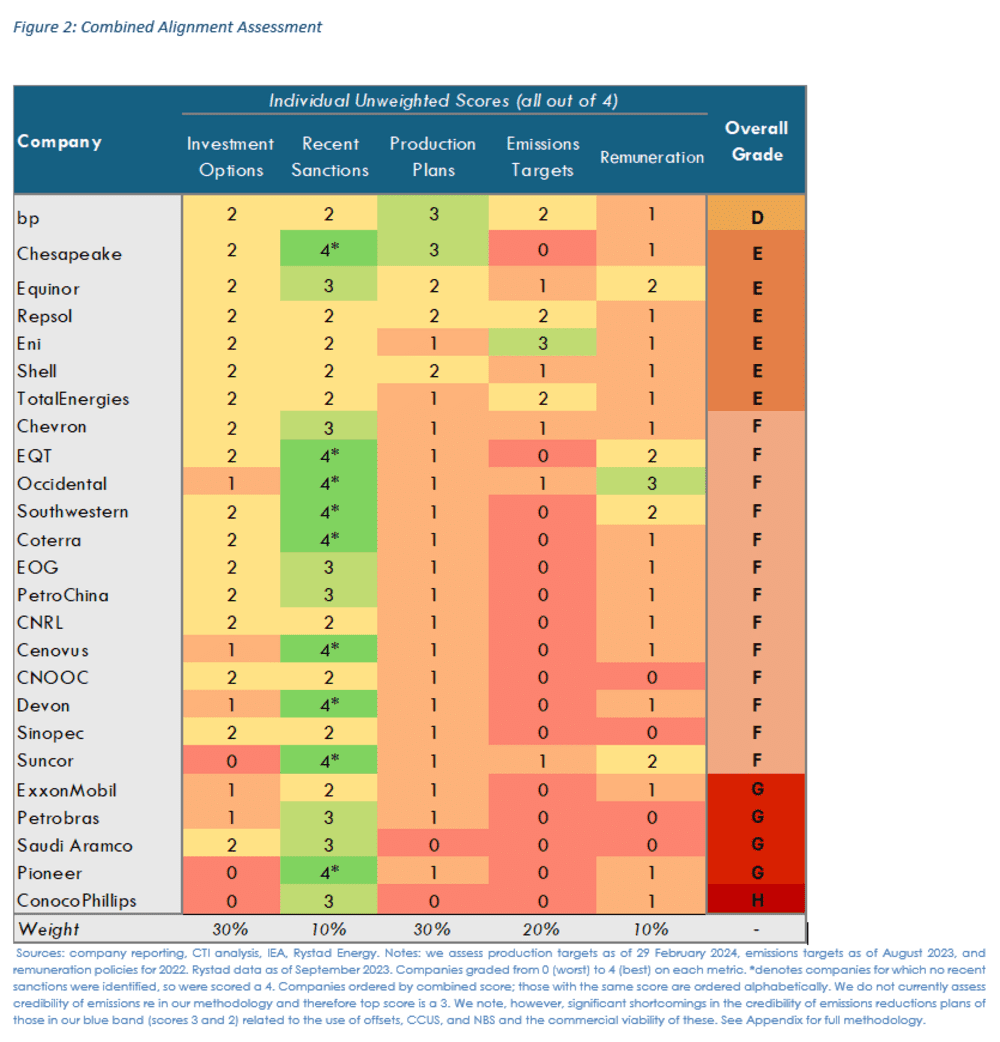

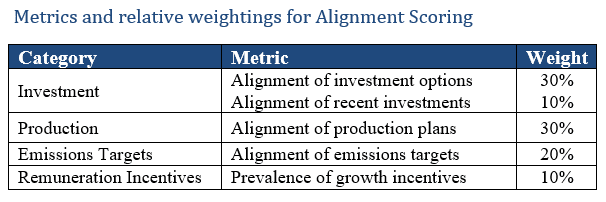

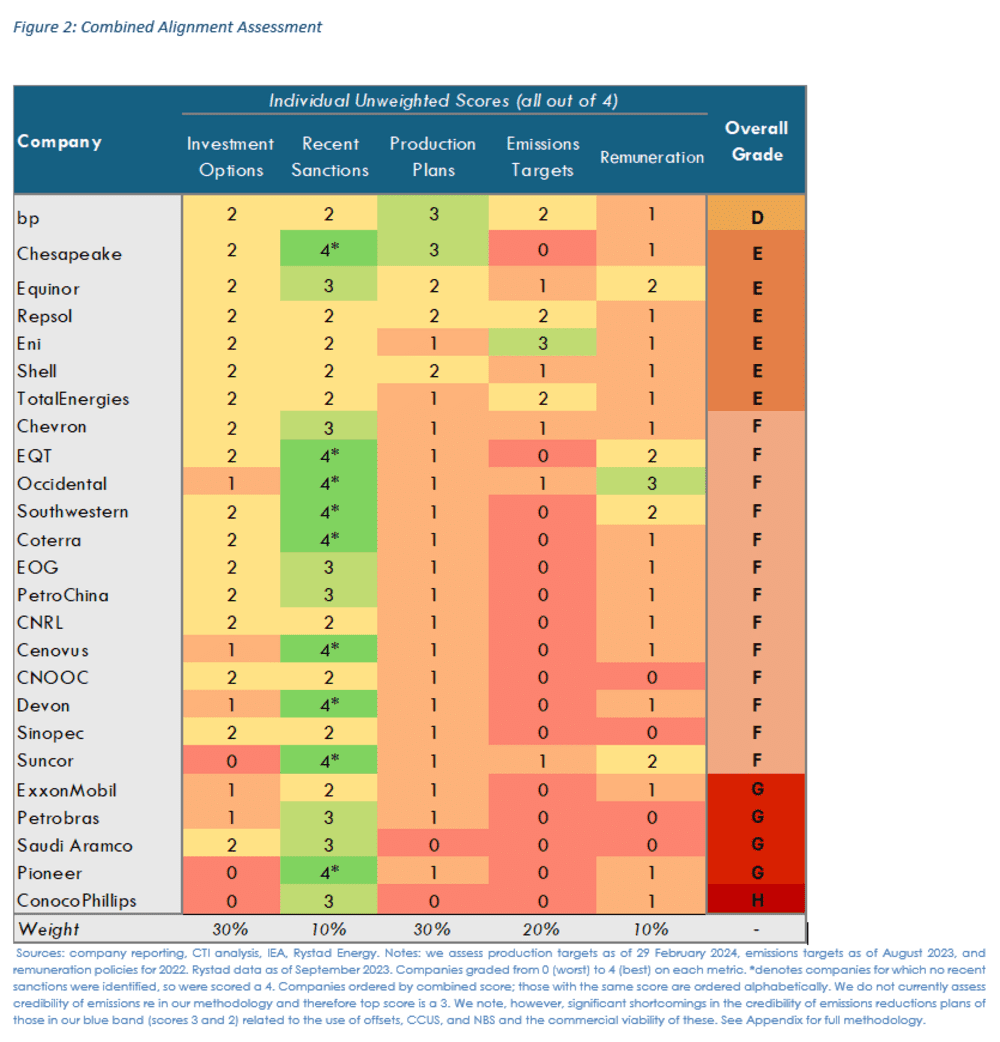

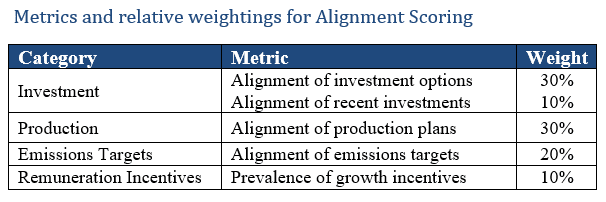

To further empower investors and regulators, a new assessment scorecard released to enable investors to judge whether oil and gas companies are aligned with the Paris Agreement. The scorecard is a part of a new report from financial think tank Carbon Tracker and the first attempt to incorporate five key alignment metrics.Paris Maligned II: Climate alignment assessments reveal oil & gas company transition risk examines the 25 largest listed oil and gas companies and evaluates the extent to which they are aligned with Paris-climate goals, based on Carbon Tracker’s most recent assessments of five key metrics: Investment Options, Recent Project Sanctions, Production Plans, Emission Targets, and Executive Remuneration. It also highlights how the degree of alignment can be used to assess the extent to which companies are exposed to an accelerating energy transition where oil and gas demand weakens.  The UN Secretary General Antonio Guterres warned at COP28 in Dubai that the burning of fossil fuels must be stopped outright and a reduction or abatement in their use would not be enough to stop global warming: “We cannot save a burning planet with a fire hose of fossil fuels. The 1.5-degree limit is only possible if we ultimately stop burning all fossil fuels. Not reduce. Not abate.”[1]The following sanctioned and proposed projects highlighted in Paris Maligned II show why companies and society are in danger of failing to meet their targets under the Paris Agreement:

The UN Secretary General Antonio Guterres warned at COP28 in Dubai that the burning of fossil fuels must be stopped outright and a reduction or abatement in their use would not be enough to stop global warming: “We cannot save a burning planet with a fire hose of fossil fuels. The 1.5-degree limit is only possible if we ultimately stop burning all fossil fuels. Not reduce. Not abate.”[1]The following sanctioned and proposed projects highlighted in Paris Maligned II show why companies and society are in danger of failing to meet their targets under the Paris Agreement: We then grade companies from A to H based on their combined alignment score. Please refer to Appendix 6.3 of the report for detail on the full methodology.[1] https://www.reuters.com/business/environment/un-chief-says-ending-fossil-fuel-use-is-only-way-save-burning-planet-2023-12-01/[2] Rystad Energy reports aggregate capex for the project to be c.$9bn from 2024-2030. Bp has said that the project is likely to cost between $15-20bn. S&P Global, BP readies new Gulf of Mexico oil project Kaskida after Q1 output bounce (02/05/23)

We then grade companies from A to H based on their combined alignment score. Please refer to Appendix 6.3 of the report for detail on the full methodology.[1] https://www.reuters.com/business/environment/un-chief-says-ending-fossil-fuel-use-is-only-way-save-burning-planet-2023-12-01/[2] Rystad Energy reports aggregate capex for the project to be c.$9bn from 2024-2030. Bp has said that the project is likely to cost between $15-20bn. S&P Global, BP readies new Gulf of Mexico oil project Kaskida after Q1 output bounce (02/05/23)

All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.

“Companies worldwide are publicly stating they are supportive of the goals of the Paris-Agreement, and claim to be part of the solution in accelerating the energy transition. Unfortunately, however, we see that none are currently aligned with the goals of the Paris Agreement, albeit there are clear differences between companies. This report gives evidence for investors and other stakeholders to hold companies to account.”

-Maeve O’Connor, Oil and Gas Analyst and report author

Almost all the companies in our universe are targeting new developments and production increases in the near-term, though in the longer-term, Repsol, Equinor, and Shell are aiming to keep production volumes flat, and bp is planning for a decline.Companies are graded on a scale of A-H, with A being potentially aligned with the goals of the Paris Agreement, and H the furthest from being aligned with Paris goals and reflecting company strategy more consistent with a 2.4C – or worse – outcome.The highest ranked company bp received a D-grade, while the lowest ranked ConocoPhillips receives an H. Four of the top five highest scoring companies are European (bp, Repsol, Equinor, Eni) while three of the five lowest scoring firms are US domiciled (ExxonMobil, Pioneer, ConocoPhillips). The UN Secretary General Antonio Guterres warned at COP28 in Dubai that the burning of fossil fuels must be stopped outright and a reduction or abatement in their use would not be enough to stop global warming: “We cannot save a burning planet with a fire hose of fossil fuels. The 1.5-degree limit is only possible if we ultimately stop burning all fossil fuels. Not reduce. Not abate.”[1]The following sanctioned and proposed projects highlighted in Paris Maligned II show why companies and society are in danger of failing to meet their targets under the Paris Agreement:

The UN Secretary General Antonio Guterres warned at COP28 in Dubai that the burning of fossil fuels must be stopped outright and a reduction or abatement in their use would not be enough to stop global warming: “We cannot save a burning planet with a fire hose of fossil fuels. The 1.5-degree limit is only possible if we ultimately stop burning all fossil fuels. Not reduce. Not abate.”[1]The following sanctioned and proposed projects highlighted in Paris Maligned II show why companies and society are in danger of failing to meet their targets under the Paris Agreement:- Equinor & Aker BP sanctioned the $2.4bn Munin project in Norway – see Table 3

- Total & CNOOC sanctioned the $1.8bn Jobi-Rii project in Uganda – see Table 3

- Eni sanctioned the $1.3bn Baleine Phase 2 project in the Cote D’Ivore – see Table 3

- bp’s massive c.$15bn ultra deepwater Kaskida project, which bp appears to be gearing up to sanction[2] is the largest planned project falling outside of APS/1.7˚C, see table 1

- TotalEnergies appears to be on track to sanction the Cameia offshore project in Angola; see Table 1

- Chevron, is targeting a 33% production increase over 2022 levels by 2027 – see Table 2

- ConocoPhillips is targeting a 47% increase in production by the end of the decade (vs 2022), see Table 2

We then grade companies from A to H based on their combined alignment score. Please refer to Appendix 6.3 of the report for detail on the full methodology.[1] https://www.reuters.com/business/environment/un-chief-says-ending-fossil-fuel-use-is-only-way-save-burning-planet-2023-12-01/[2] Rystad Energy reports aggregate capex for the project to be c.$9bn from 2024-2030. Bp has said that the project is likely to cost between $15-20bn. S&P Global, BP readies new Gulf of Mexico oil project Kaskida after Q1 output bounce (02/05/23)

We then grade companies from A to H based on their combined alignment score. Please refer to Appendix 6.3 of the report for detail on the full methodology.[1] https://www.reuters.com/business/environment/un-chief-says-ending-fossil-fuel-use-is-only-way-save-burning-planet-2023-12-01/[2] Rystad Energy reports aggregate capex for the project to be c.$9bn from 2024-2030. Bp has said that the project is likely to cost between $15-20bn. S&P Global, BP readies new Gulf of Mexico oil project Kaskida after Q1 output bounce (02/05/23) All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.