Catholic Investor Engagement with Brazil to protect the Amazon rainforest and the indigenous population

Q&A with Tommy Piemonte, Head of Sustainable Investment Research at Bank für Kirche und Caritas (BKC), a Catholic church Bank based in Paderborn, Germany

Have you already read?

How to do engagement: alone, together and everywhere | Bank für Kirche und Caritas

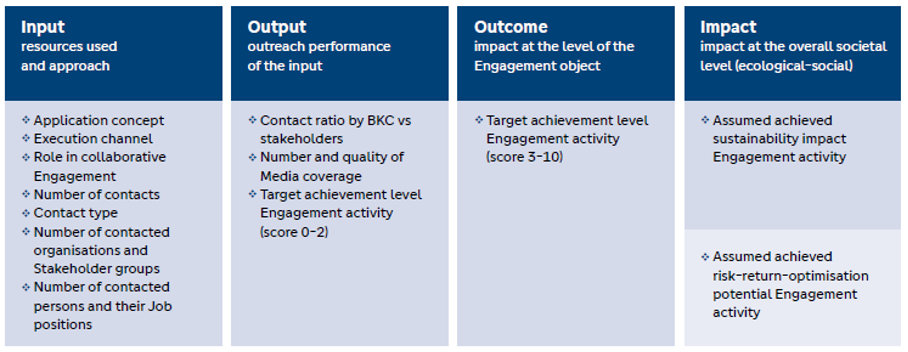

That sounds very interesting, please give us a deeper insight into your impact measurement model?Of course, I cannot explain the entire model in detail in a short interview, as it would go beyond the limits, but I will try to outline a few important key points.We have translated the four dimensions of the IOOI impact logic to engagement activities in our model as follows:

Input – The resources used and the approach taken in the engagement activity.

Output – The performance arising from the input in terms of who is reached and with what reaction.

Outcome – The actions or impacts resulting from the input and output at the level of the engagement object with regard to the target achievement level of the engagement demands.

Impact – The overall societal (ecological-social) effects resulting from the outcome with regard to the sustainability impact and the risk-return-optimisation potential.

The core element and challenge in applying the IOOI impact logic to engagement is that meaningful indicators and evaluation criteria for an engagement activity need to be identified and translated into the IOOI impact logic. BKC has focused on analysing, on the basis of its published engagement guideline, which indicators and evaluation criteria provide a meaningful picture of the approach and enable measurement of the engagement activities carried out by BKC. As a result, BKC applies the following indicators and evaluation criteria: While measuring and evaluating the input and the output of engagement activities is relatively easy, measuring and evaluating the outcome, and especially the impact, is much more difficult. Measuring impact at the overall societal (ecological-social) level is generally associated with various difficulties and usually only possible after a longer period of time. In order to be able to counter the imponderables described, BKC uses an evaluation model consisting of three steps that build on each other:Step 1 - Preparation phase:Appropriate engagement objects and engagement activities are selected on the basis of factors to be examined in advance of an engagement. Thereby, the focus is on two questions that need to be answered:

While measuring and evaluating the input and the output of engagement activities is relatively easy, measuring and evaluating the outcome, and especially the impact, is much more difficult. Measuring impact at the overall societal (ecological-social) level is generally associated with various difficulties and usually only possible after a longer period of time. In order to be able to counter the imponderables described, BKC uses an evaluation model consisting of three steps that build on each other:Step 1 - Preparation phase:Appropriate engagement objects and engagement activities are selected on the basis of factors to be examined in advance of an engagement. Thereby, the focus is on two questions that need to be answered:What sustainability impact is attributed to the sustainability topic and the engagement object?

What risk-return-optimisation potential does the sustainability topic and the engagement object offer in the portfolio context of BKC?

Both when defining the objective of the engagement activity and when defining the engagement object, the assumed sustainability impact as well as the assumed risk-return-optimisation potential are each assessed with a score, according to a scale defined by BKC.Step 2 - Execution phase:The target achievement level of the engagement activity is measured by a score, according to a scale defined by BKC, which is used to assess how the engagement object has achieved the goal required of it within an engagement activity respectively to what extent it has implemented the entirety of the engagement demands.Step 3 - Follow-up phase:The assumed impact provoked by the engagement activity can be calculated in the designed model on the basis of steps 1 and 2 and includes two areas. One area is expressed as ”Assumed achieved sustainability impact Engagement activity“ with a total score between score 0 ”non-existent“ to score 10 ”very high“. The calculation of the score works as follows:Sustainability impact topic score x Sustainability impact engagement object score x Target achievement level engagement activity score ÷ Maximum achievable score of the sustainability impact of an engagement activity x 10.The other area is expressed as ”Assumed achieved risk-return-optimisation potential engagement activity“ and the calculation is quite similar to the first area. aboutTommy Piemonte is Head of Sustainable Investment Research at Bank für Kirche und Caritas (BKC), a Catholic church Bank based in Paderborn, Germany. He is mainly responsible for the further development, operational implementation and monitoring of the bank’s ethically-sustainable investment strategy. He is also responsible for the associated engagement activities. In this context, he is the Bank’s representative and a founding member of the European engagement network of institutional investors Shareholders for Change.Above all, his expertise helps the Bank’s institutional clients, such as charitable foundations and church and charitable institutions, to develop and implement an individual, ethically-sustainable investment strategy. Prior to joining BKC, Tommy Piemonte was Head of the German sustainability rating agency at imug in Hanover (research and sales network partner of Moody’s ESG Solutions). The graduate economist complements his experience with many years of work in the financial market, including as a securities specialist at Deutsche Bank. He has written numerous publications on sustainable investment. Mr. Piemonte studied economics at Universities in Nürtingen (Germany) and Rome (Italy).All opinions expressed are those of the author and/or quoted sources. investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics.