© Gab Gould

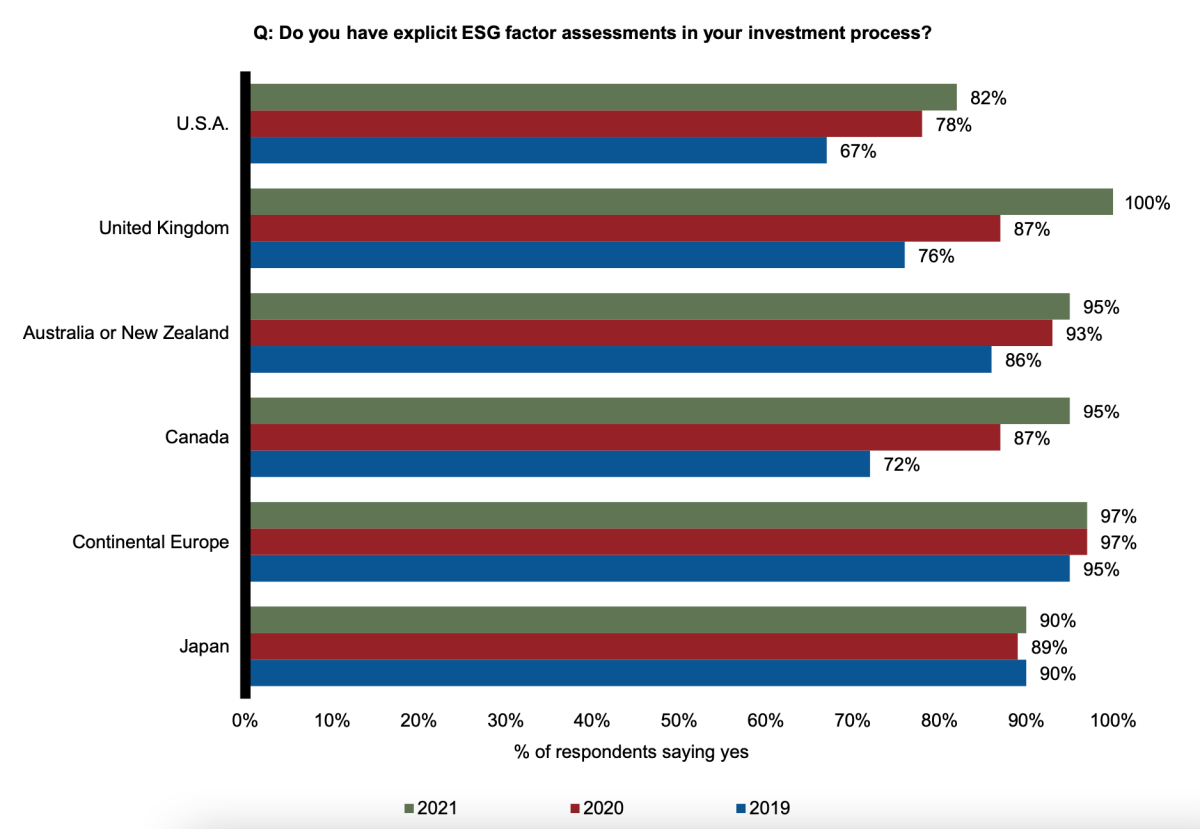

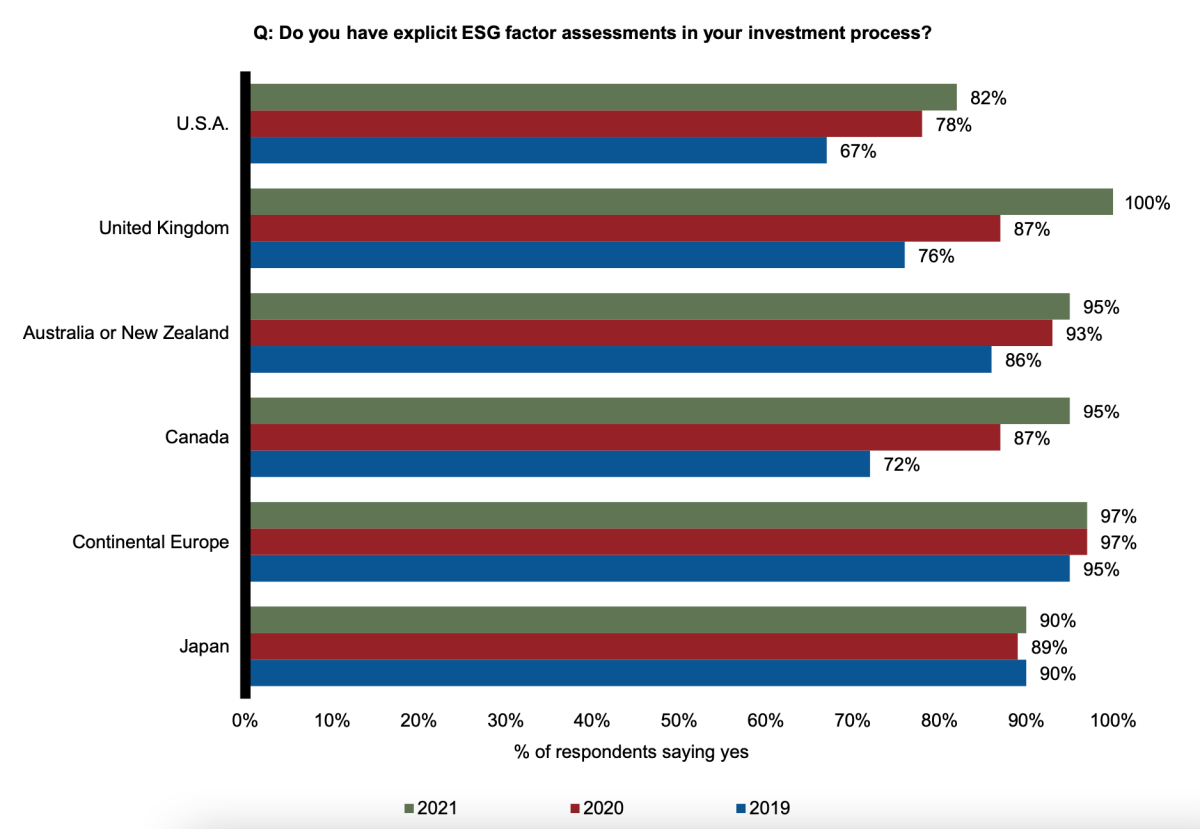

Insights from the 2021 Annual ESG Manager Survey, published by Russell Investments, November 2021 ESG-specific consideration by asset managers: UK managers lead the way"In order to incorporate ESG considerations, we believe that it is critical to conduct explicit ESG assessments in the investment process on a regular basis. We observe whether asset managers have additional inputs specific to ESG-related topics, which are often non-traditional or non-financial-metric-driven considerations.[caption id="attachment_6395" align="alignleft" width="246"] © Bettina May, Head of Distribution for Germany and Austria, Russell Investments[/caption]82% of the respondents said they incorporate explicit qualitative or quantitative ESG consideration assessments at the corporate or sovereign level systematically in their investment process, compared to 78% in 2020.Exhibit two illustrates the year-over-year changes by region, highlighting that the highest percentage increase came from firms based in the U.K, with the most improvements seen among smaller firms, likely due to the local pressure from the client base and regulation."[caption id="attachment_6397" align="aligncenter" width="441"]

© Bettina May, Head of Distribution for Germany and Austria, Russell Investments[/caption]82% of the respondents said they incorporate explicit qualitative or quantitative ESG consideration assessments at the corporate or sovereign level systematically in their investment process, compared to 78% in 2020.Exhibit two illustrates the year-over-year changes by region, highlighting that the highest percentage increase came from firms based in the U.K, with the most improvements seen among smaller firms, likely due to the local pressure from the client base and regulation."[caption id="attachment_6397" align="aligncenter" width="441"] © Russell Investments[/caption]"Furthermore, the year-over-year change by asset class shows that 89% of the equity managers have demonstrated the largest increase to explicit ESG assessments in the process, despite being slightly lower than 93% of fixed income managers, 92% of private market managers and 96% of real asset managers.When comparing data at the asset level, the largest year-over-year increase came from smaller firms, narrowing the gap with larger firms and indicating that smaller firms are catching up in terms of integration."Source: Russell Investments investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics. All opinions expressed are those of the author or contributing source.

© Russell Investments[/caption]"Furthermore, the year-over-year change by asset class shows that 89% of the equity managers have demonstrated the largest increase to explicit ESG assessments in the process, despite being slightly lower than 93% of fixed income managers, 92% of private market managers and 96% of real asset managers.When comparing data at the asset level, the largest year-over-year increase came from smaller firms, narrowing the gap with larger firms and indicating that smaller firms are catching up in terms of integration."Source: Russell Investments investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics. All opinions expressed are those of the author or contributing source.

© Bettina May, Head of Distribution for Germany and Austria, Russell Investments[/caption]82% of the respondents said they incorporate explicit qualitative or quantitative ESG consideration assessments at the corporate or sovereign level systematically in their investment process, compared to 78% in 2020.Exhibit two illustrates the year-over-year changes by region, highlighting that the highest percentage increase came from firms based in the U.K, with the most improvements seen among smaller firms, likely due to the local pressure from the client base and regulation."[caption id="attachment_6397" align="aligncenter" width="441"]

© Bettina May, Head of Distribution for Germany and Austria, Russell Investments[/caption]82% of the respondents said they incorporate explicit qualitative or quantitative ESG consideration assessments at the corporate or sovereign level systematically in their investment process, compared to 78% in 2020.Exhibit two illustrates the year-over-year changes by region, highlighting that the highest percentage increase came from firms based in the U.K, with the most improvements seen among smaller firms, likely due to the local pressure from the client base and regulation."[caption id="attachment_6397" align="aligncenter" width="441"] © Russell Investments[/caption]"Furthermore, the year-over-year change by asset class shows that 89% of the equity managers have demonstrated the largest increase to explicit ESG assessments in the process, despite being slightly lower than 93% of fixed income managers, 92% of private market managers and 96% of real asset managers.When comparing data at the asset level, the largest year-over-year increase came from smaller firms, narrowing the gap with larger firms and indicating that smaller firms are catching up in terms of integration."Source: Russell Investments

© Russell Investments[/caption]"Furthermore, the year-over-year change by asset class shows that 89% of the equity managers have demonstrated the largest increase to explicit ESG assessments in the process, despite being slightly lower than 93% of fixed income managers, 92% of private market managers and 96% of real asset managers.When comparing data at the asset level, the largest year-over-year increase came from smaller firms, narrowing the gap with larger firms and indicating that smaller firms are catching up in terms of integration."Source: Russell Investments About the surveyRussell Investments conducted its 2021 annual ESG survey across equity, fixed income, real assets and private markets asset managers from around the globe. The survey aims to assess their attitudes toward responsible investing and how managers integrate ESG considerations into their investment processes. This year’s survey covered a wide range of topics, including the following:

- Commitment to net zero by 2050

- ESG data sources

- The importance of ESG-specific considerations

- How ESG insights were formed

- Climate risk: the greatest issue flagged by asset managers' clients

- The rise in dedicated responsible investing resources

- Engagement activities

- Product offerings

- Reporting and data