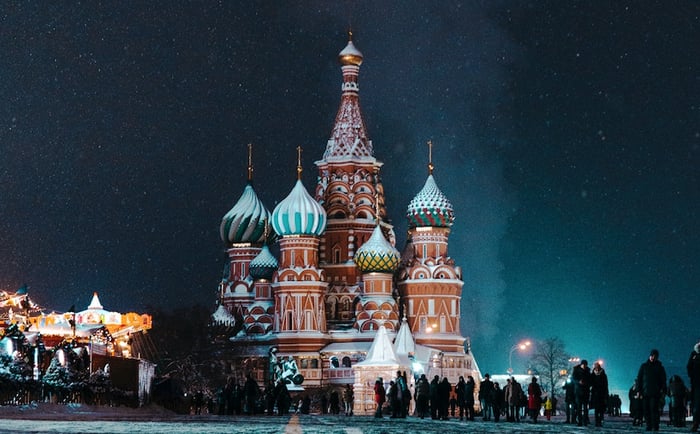

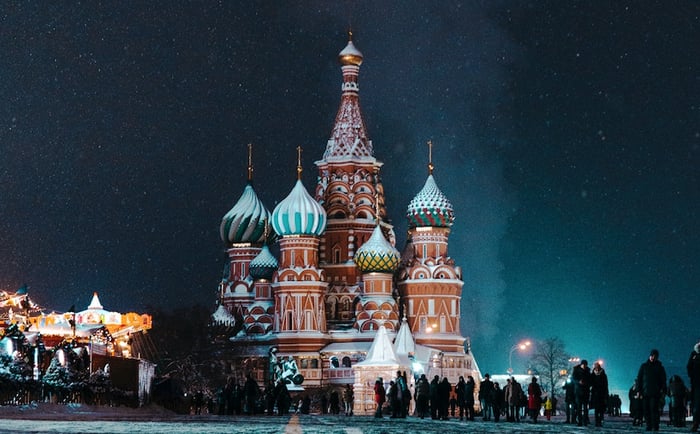

© Nikita Karimov

Matches 100g CO2 gas-power threshold in EU Parliament’s approved ActClimate Bonds Initiative welcomes taxonomy as “in line with international best practice”

Yesterday at COP26, the state development bank VEB.RF announced the official adoption of the Russian Green Taxonomy. The Taxonomy was developed with the ambition of compatibility with international best practice and VEB.RF designed it to be broadly in line with the Climate Bonds Taxonomy and with the 'substantial contribution' components of the EU Taxonomy.Sean Kidney, CEO, Climate Bonds Initiative said, “Institutional investors have proven their appetite for green bonds, but they seek confidence and guidance to commit the trillions required for rapid decarbonisation to Net Zero. The Russian Taxonomy adds to the wave of regulators that are adopting international best practice and providing credible green definitions.”“Taxonomies adopting common science-based, dynamic, and conscious principles are key to harmonisation that facilitates cross-border flows of green capital. If it is green, they will invest.”The Russian taxonomy covers waste management, energy, construction, industry, transport, water supply, biodiversity, and agriculture. The energy criteria include science-based thresholds for electricity generation, based on the recommendations of the technical expert group (EU TEG) on sustainable finance for the EU Taxonomy of sustainable activities.The 100g CO2e/kWh threshold for electricity generation is a cornerstone of the EU Taxonomy. The adoption of this threshold for gas-fired power signals to international investors that the Russian Taxonomy is aligned with global definitions of green investment, and independent of fossil fuel interests.The 'adaptation criteria' of the Taxonomy allow Russian companies to indicate to investors that they are making an effort to adapt to climate risks. They also provide an opportunity to develop transition criteria for Russian industry. Development of credible transition pathways would provide crucial guidance to Russian companies on how they can reach the government’s 2060 net zero target. There will be more on this next year.Sean Kidney added, “The Russian taxonomy does not, like most taxonomies, yet address many of the ‘Do No Significant Harm’ aspects of the EU Taxonomy. Plus, it does include nuclear, not in the EU Taxonomy at this stage, although it is in the Chinese taxonomy and is expected to be in the UK taxonomy.”“The EU technical expert group made it clear that nuclear was low carbon but proposed more investigation of challenging 'Do No Significant Harm' issues; that process is still underway. With VEB.RF committing to continued development of the taxonomy, we expect further updates next year.”“Nuclear will remain a matter of contention. But most critically the Russian taxonomy’s gas-fired power criteria are absolutely in line with the EU Delegated Act, passed by the European Parliament last month. That consistency will make life a lot easier for investors.”Alexey Miroshnichenko, First Deputy Chairman, VEB.RF commented, “The Russian green finance system, which includes the taxonomy of green projects, was developed to help the country reach the targets of the Paris agreement and fund the green transition. We believe that Russian market for green projects has the potential to become one of the biggest in the world. The national taxonomy provides a legal framework for international investors to profit from Russia’s decarbonisation.” investESG.eu is an independent and neutral platform dedicated to generating debate around ESG investing topics. All opinions expressed are those of the author or contributing source.

Published by

investESG

investESG

investESG

investESG