INSIGHT byKarim Tadjeddine, Partner, McKinseyRuchi Sharma, Associate Partner, McKinseyZdravko Mladenov, Partner, McKinseyJonathan Dimson, Senior Partner, McKinseyThis article was first published by the World Economic Forum in collaboration with McKinsey and Company, and on McKinsey.com.

New research by McKinsey show's the devastating affect coronavirus is having on Europe's small and medium-size enterprises (SMEs).

SMEs employ more than two-thirds of Europe's workforce and contribute substantially to Europe's economy.

But due to the pandemic, one fifth of businesses now expect to default on loans and lay off staff.

If revenues were to remain steady, 55% of SMEs could shut down by September 2021, a figure that rises to 77% if revenues worsen.

Small and medium-size enterprises (SMEs) have been the lifeblood of the European economy, accounting for more than two-thirds of the workforce and more than half of the economic value added.1 Yet the results of a recent McKinsey survey, conducted in August, 2020, of more than 2,200 SMEs in five European countries—France, Germany, Italy, Spain and the United Kingdom—indicate just how hard their prosperity has been hit by the COVID-19 crisis.

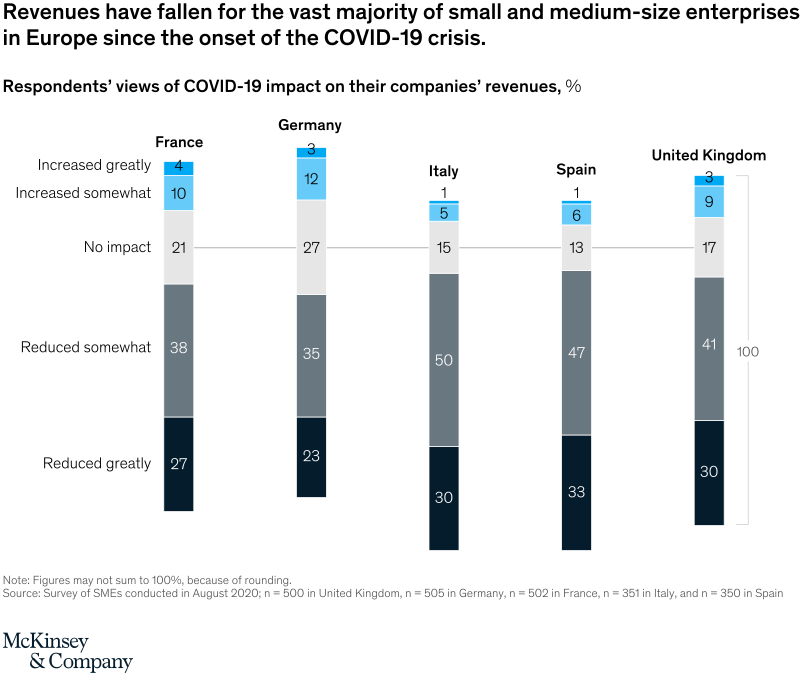

Exhibit one: Revenue has fallen for Europe's SMEs since the start of the pandemic. © McKinsey & Company[/caption] Few SMEs appear optimistic about the prospects for improvement anytime soon given their views on the state of the economy. Overall, 80 percent weighed the economy as somewhat weak to extremely weak. But here, too, we see material country variations. In Germany, where the economy is forecast to contract less than elsewhere, 39 percent of SMEs weighed the economy as somewhat strong to extremely strong. By comparison, in Italy the figure was just 10 percent (Exhibit 2). [caption id="attachment_4402" align="aligncenter" width="804"]

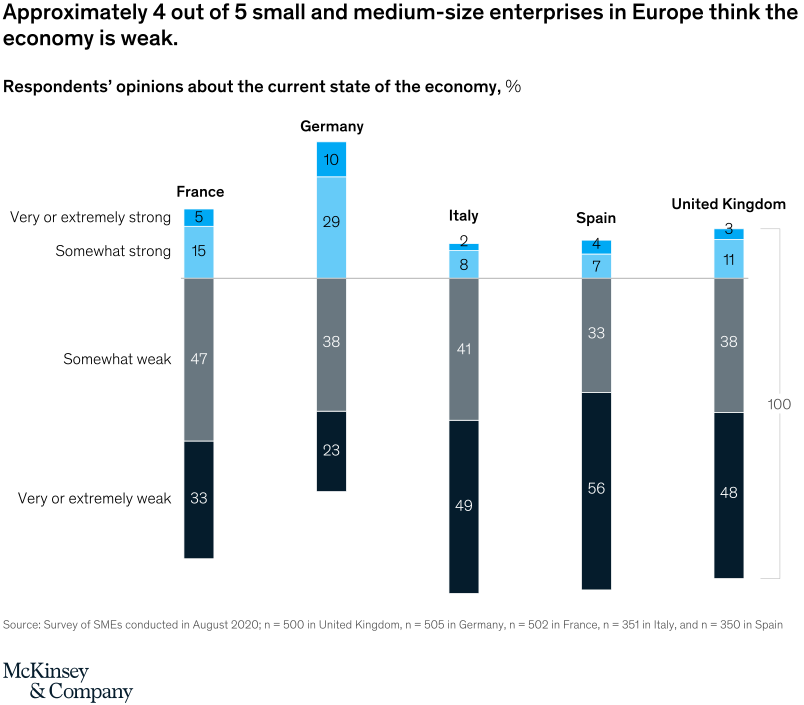

Exhibit one: Revenue has fallen for Europe's SMEs since the start of the pandemic. © McKinsey & Company[/caption] Few SMEs appear optimistic about the prospects for improvement anytime soon given their views on the state of the economy. Overall, 80 percent weighed the economy as somewhat weak to extremely weak. But here, too, we see material country variations. In Germany, where the economy is forecast to contract less than elsewhere, 39 percent of SMEs weighed the economy as somewhat strong to extremely strong. By comparison, in Italy the figure was just 10 percent (Exhibit 2). [caption id="attachment_4402" align="aligncenter" width="804"] Exhibit two: Perception of strength of the European economy, by SMEs.

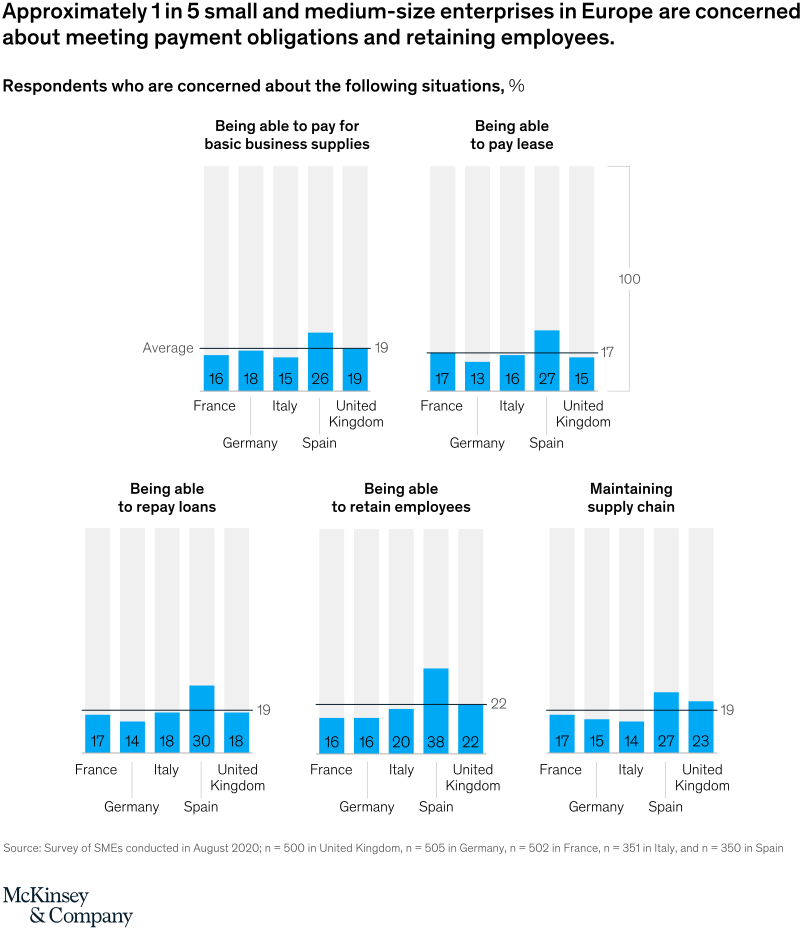

Exhibit two: Perception of strength of the European economy, by SMEs.© McKinsey & Company[/caption] There were also differences across countries on the extent to which the pandemic is impacting SME financial positions, challenging the ability to retain staff or pay loans and leases. For example, Spanish SMEs are consistently among the more pessimistic (Exhibit 3). Thirty percent of Spanish SMEs were concerned about being able to pay back loans, compared with 14 percent in Germany. Similarly, 38 percent of Spanish SMEs feared they might not be able to retain their employees—a figure that drops to only 16 percent in Germany and France. Noteworthy, too, is that on average across Europe, 14 percent of SMEs said they were struggling to staff their operations due in part to so many people being on sick leave or having to quarantine.

Exhibit three: A fifth of European businesses are concerned about payment obligations.

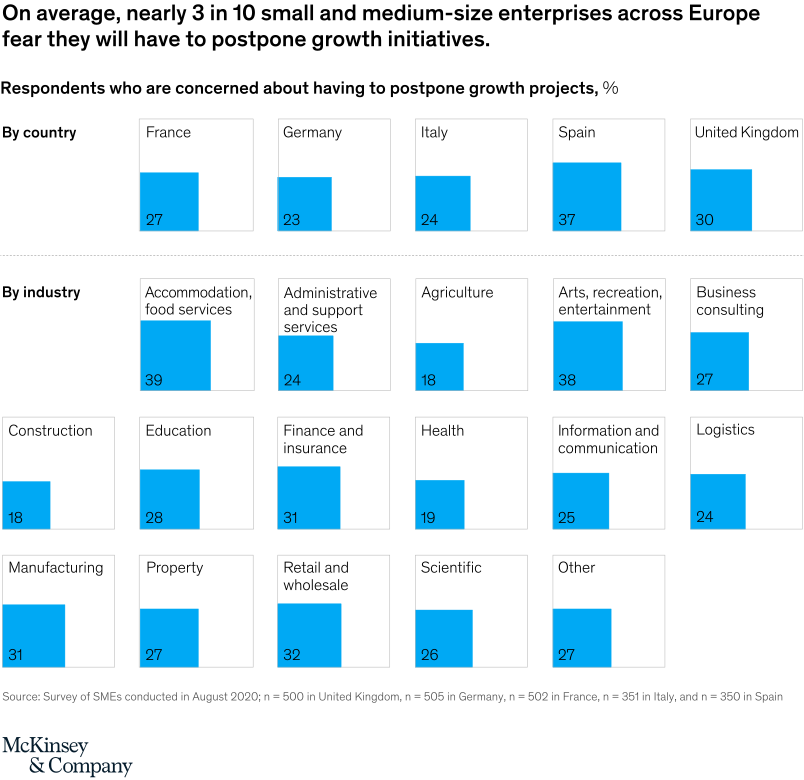

Exhibit three: A fifth of European businesses are concerned about payment obligations.© McKinsey&Company[/caption] Growth projects are also at risk. Overall, 28 percent of those surveyed said they were concerned they might have to postpone them, though the figure rose to 37 percent among Spanish SMEs and 30 percent among UK ones. Hardest hit will be the accommodation, food services, arts, entertainment, and recreation sectors, according to the survey. Nearly 40 percent of SMEs in these sectors said projects might have to be put on hold, compared with 20 percent of SMEs in sectors at the other end of the scale, namely health, agriculture, and construction (Exhibit 4). [caption id="attachment_4410" align="aligncenter" width="804"]

Exhibit four: Growth is expected to stall across Europe. © McKinsey&Company[/caption]

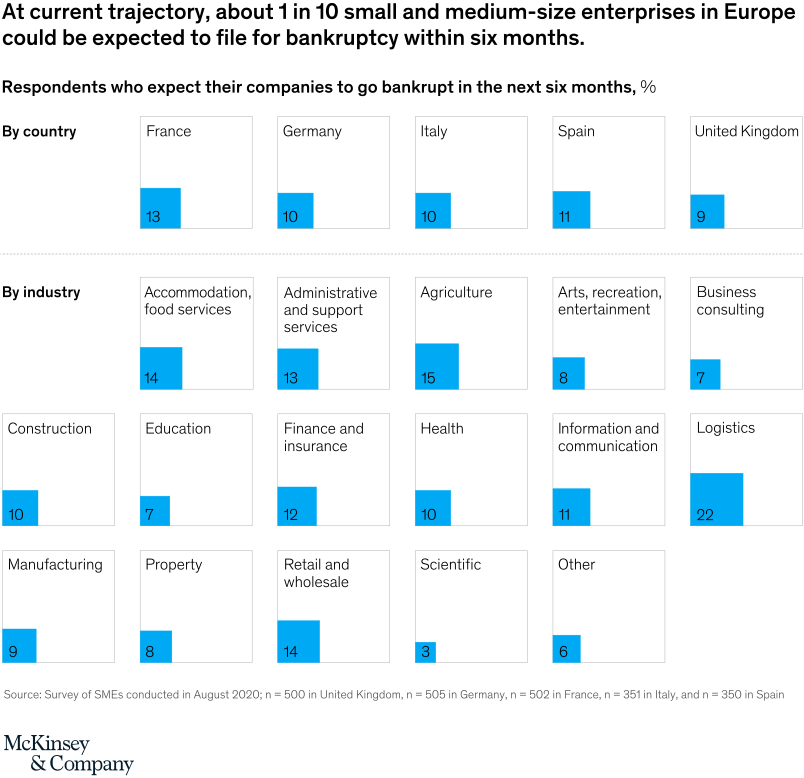

Exhibit four: Growth is expected to stall across Europe. © McKinsey&Company[/caption]  Exhibit five: 10% of Europe's businesses expect they will have to file for bankruptcy within the next half a year.

Exhibit five: 10% of Europe's businesses expect they will have to file for bankruptcy within the next half a year.© McKinsey & Company[/caption]

If revenues were to remain steady, 55 percent of SMEs worry they may shut down by September 2021.

If the situation were to worsen and revenues decreased by a further 10 to 30 percent, 77 percent of SMEs said they may be out of business by September 2021.

If the situation were to improve and revenues increased by 10 to 30 percent, 39 percent of SMEs said they may nevertheless be out of business by September 2021.

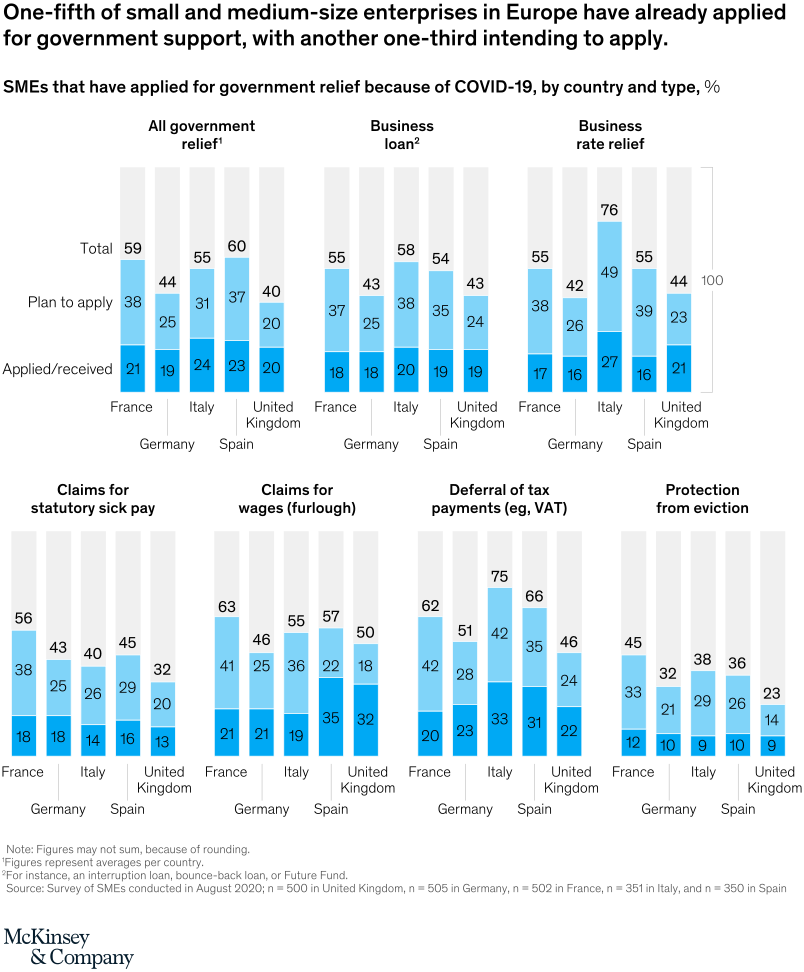

Exhibit six: Government support has been helping SMEs. © McKinsey & Company[/caption]

Exhibit six: Government support has been helping SMEs. © McKinsey & Company[/caption] investESG

investESG