Fixed income: why investors must rebuild core allocations

The time is ripe for investors to rebuild core fixed income allocations. Why? Because the risk/return profile of such assets has not looked this strong in years, presenting the opportunity to lock in long-term value.

Authors: Rodrigo Araya Arancibia (left) and Hicham Zemmouri (right), Managing Directors Fixed Income, Anthos Fund & Asset Management

Key takeaways

“Core” fixed income assets have reached their most attractive valuation levels in years, largely thanks to higher inflation and interest rates.Now, expectations for moderating inflation and lower interest rates provide good reason for investors to lock in long-term value, by investing in these core assets at their current attractive prices.We believe the European aggregate bond universe is a worthwhile starting point to re-build core allocations for two reasons:It is broad, which means you can access diversifying assets alongside government and high-quality corporate bonds (when appropriate) to help boost returns.Europe provides exciting opportunities for responsible investments. Use the Sustainable Financial Disclosure Regulation (SFDR) guidance, sustainable bond markets, and ESG integration techniques to sift through the options.The result is a more diversified core portfolio that enhances returns, keeps risk levels desirably low, and demonstrates sustainability. Such a portfolio can help align investments with values, making that capital work to help solve global challenges.Here, we introduce a new market proposition, designed specifically to answer these needs.

Introduction

It’s been some time since core fixed income assets like government debt and high-quality corporate bonds were in favour. With valuations at levels not seen in many years and an environment of higher inflation here to stay, now is the time for investors to rebuild their core allocations to optimise risk-adjusted returns over the coming years.

Furthermore, the ever-exacerbating environmental and social threats call for investors to rebuild those allocations responsibly so that they may at least do no harm, and over time work towards being part of the solution instead.

Core no longer a bore

Why core, why now?

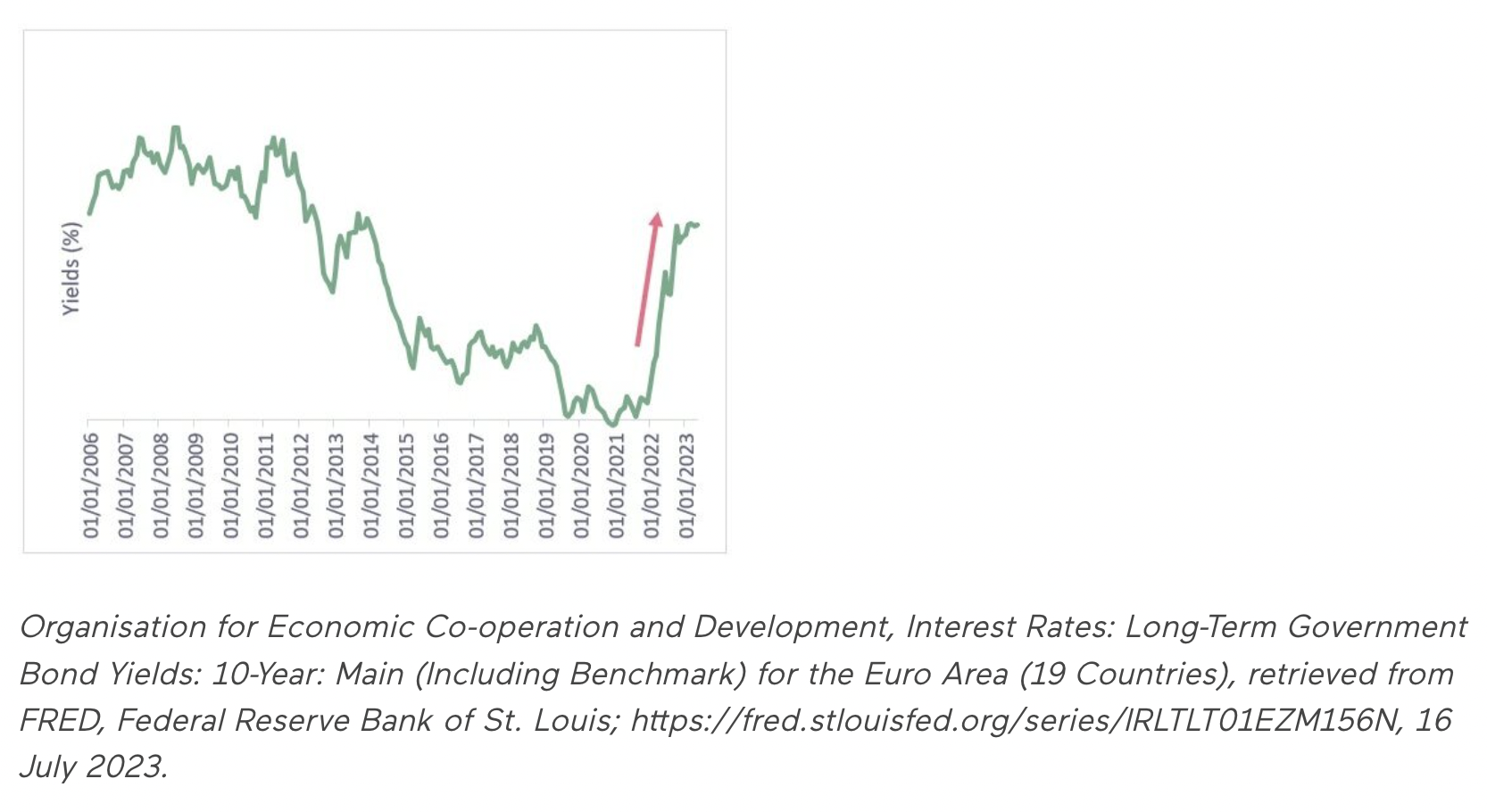

One macroeconomic story investors need to understand is why core assets represent such a valuable opportunity now; it has to do with why bond markets re-priced in 2022. Some of the many consequences of the pandemic, from supply chain issues and pent-up demand, to the impacts of stimulus in markets and rising commodity prices, all combined to push up expectations about inflation. The Russia/Ukraine war then exacerbated things, and the result saw bond markets re-price considerably in 2022 (see pink arrow in chart).

In 2023, the actions of central banks to curb inflation resulted in the most aggressive rate hiking campaigns seen in years. Initially, investors dined on the phenomenal yields in fixed income markets with high risk/reward potential – emerging market debt and high yield, for example.

However, high rates and tighter credit conditions may take their toll on riskier fixed income markets moving forward.

We believe this provides a strong case for investors to re-consider the now considerably attractive valuations of core fixed income markets. Two questions that remain are “where” and “how” to best do that.

Where to focus

It’s important to start with the universe. An advantage of being multi-sector and multi-manager bond investors is the fact that we invest across a number of different managers and strategies with different bond universes. That means we can agnostically assess the long-term drivers of markets, listen to what our clients need most, and design suitable strategies without judgment or bias.

When we embarked on rebuilding a core allocation for one of our long-standing clients, we settled on the European aggregate bond market for a few reasons. “Aggregate” includes high-quality bonds issued in the eurozone, including government, corporate, securitised, and covered bonds. Such a universe enables a strategic asset allocation into core, but also enables us (as our clients’ investment manager) to seek additional sources of returns outside the usual boundaries of traditional core assets.

Europe is also leading the way with responsible bond investing. From the growth in sustainability bonds, to the way ESG is integrated, to advancement in evidence-based methods and supportive regulations like the SFDR, Europe represents a market rich with opportunities. This means more investors can back worthwhile projects, and do so at scale given we are talking about core (and so larger) capital allocations.

How to optimise the portfolio

Leveraging all the European aggregate bond market has to offer comes down to two things.How well investors can navigate volatility and opportunities, and how well they can maximise the opportunity set created by responsible investment trends.

At Anthos Fund & Asset Management (Anthos), we believe our edge lies in being able to do both. For one, we are active, fund of fund investment managers able to adjust exposures flexibly, which can prove immensely beneficial in times of heightened uncertainty.

A portfolio with core strength…

When looking at core portfolio allocations, we believe it is important to select strategies and assets that are a naturally good fit for long-term investors. That’s because of the intended defensive nature of a core portfolio; this is not the place for high risk taking. For example, for the largest allocation in a core portfolio, government bonds with an average duration of 5 – 7 years make sense (not too short, not too long). But to ensure investors can take advantage of changing market environments, allocating to a fund that expresses low volatility, low costs, high diversification in terms of duration and geography, as well as having specific considerations to address climate change can provide assurance that the largest allocation in the core portfolio meets both financial and ESG objectives.

Exposure to an actively managed portfolio of investment grade corporate bonds, with the inclusion of carefully selected and managed off-benchmark strategies within high yield, securitised, and covered bonds can be used to boost excess returns, and provide diversification.

Harnessing responsible investment

We look at sustainability through a dual lens: ESG as a risk-management approach that should reduce downside risks; and also seeing strategies with ESG strengths or specific sustainable objectives adding potential value to the portfolio.

The wave of regulatory action has consolidated and deepened the way investors can assess sustainability credentials of financial products. We welcome this at Anthos and would say it’s important to aim high with choosing a core allocation that aligns with and reports to SFDR Article 8.

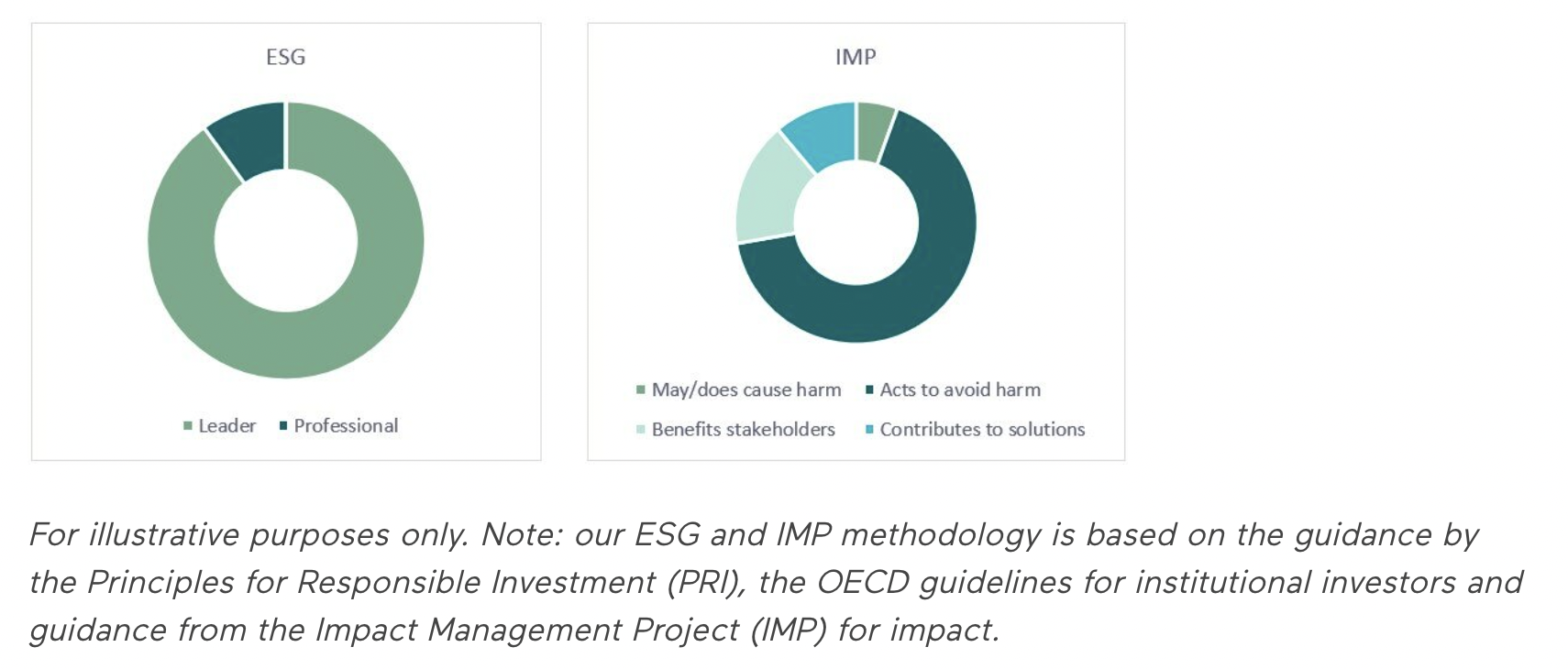

We go further than this by using a proprietary “ESG and IMP” methodology based on nearly a century of values-based investing, and decades’ experience as a pioneer in the impact investing space, combined with the latest industry-leading advice to help guide our assessments.

Again, we think it’s crucial to aim high. Using our proprietary methodology, that means aiming for all investments to be assessed as “Leader” or “Professional” in terms of ESG, and a minimum of 50% of all investments in the portfolio assessed as “Acting to avoid harm, Benefitting stakeholders, or Contributing to solutions” in terms of IMP (please refer to the back of this article for definitions explaining what these terms mean).

… And demonstrable sustainability

Conclusion

In the ever-changing landscape of investment markets, the time is ripe for investors to rebuild core fixed income allocations. Why? Because the risk/return profile of such assets has not looked this strong in years, presenting the opportunity to lock in long-term value. Re-building core responsibly is also a chance for investors to intentionally align their capital with their values. Considering the many exciting and long-term opportunities for sustainable investing in Europe that need capital investment, we think core portfolios are perfect for the job.

With that, as responsible investors, we encourage you to consider rebuilding your core fixed income allocations intentionally, responsibly, and in line with your values. Together, we can not only optimise risk-adjusted returns but also make demonstrable steps towards contributing to positive change.

Useful information

About core fixed income

Core fixed income assets refer to a group of investment securities that provide a stable and predictable stream of income over a defined period, typically through interest payments. These assets primarily include government and corporate bonds, as well as other debt instruments.

The core allocation of fixed income assets is crucial for the defensive capabilities of a mixed investment fund. Here's why:

Capital preservation: Core fixed income assets are known for their relatively lower risk compared to equities. In times of market turbulence or economic uncertainty, these assets act as a buffer, preserving capital and reducing overall portfolio volatility.Income generation: Core fixed income assets offer regular interest payments, ensuring a steady income stream for the investment fund. This income can be used to support the fund's expenses or reinvested in other assets.Diversification: Including core fixed income assets in a mixed fund enhances portfolio diversification. Bonds often have a negative correlation with equities, meaning they tend to perform well when stocks face challenges, balancing the overall performance of the portfolio.

ESG and IMP labels explained

ESG

Leader: The thought leaders, influencers, and proactive implementers. Leaders voluntarily set standards and develop new approaches and solutions to society’s problems.Professional: Fully compliant with regulations, professionals sign up to global commitments and implement clients’ policies without complaint. They have sufficient resources and good, practical governance.IMP

Act to avoid harm: Seeks to mitigate the negative impact of an investor’s portfolio, by for example incorporating ESG factors into investment decisions, accounting for and mitigating negative impact, engagement, and other activities to avoid harm.Benefit stakeholders: Seeks investments intended to generate positive outcomes for a wide range of stakeholders. This can be done by, for example, positively screening for investments that are sustainable for the world either by consistently mitigating their negative and providing positive contributions or by being in industries that traditionally provide positive outcomes, e.g. healthcare, or education.Contributes to solutions: Seeks investments intended to generate measurable significant positive, social and environmental impact for otherwise underserved stakeholders, including the environmentDownload the PDF here