We assess the daunting data challenge lurking in the latest Target Setting Protocol of the Net Zero Asset Owners Alliance.

The world is woefully behind on climate change mitigation and adaptation measures, but one of the more ambitious initiatives is the UN-convened Net Zero Asset Owners Alliance (“Alliance”). Members of the Alliance, which include 84 major institutional investors with over USD 11 trillion assets under management, commit to achieving net-zero greenhouse gas (GHG) emissions across their entire portfolios by 2050. They also commit to meeting intermediate targets every five years to demonstrate progress towards that end goal.

The Alliance members are the finance industry’s first to set intermediate targets, which, according to the third edition of the Target Setting Protocol released in January 2023, include CO2 reduction ranges for 2025 (22 – 32%) and for 2030 (40% – 60%). On an annual basis, members report publicly on progress towards their intermediate targets, including on portfolio emissions profile and emissions reductions.

A Four-Part Target Setting Approach

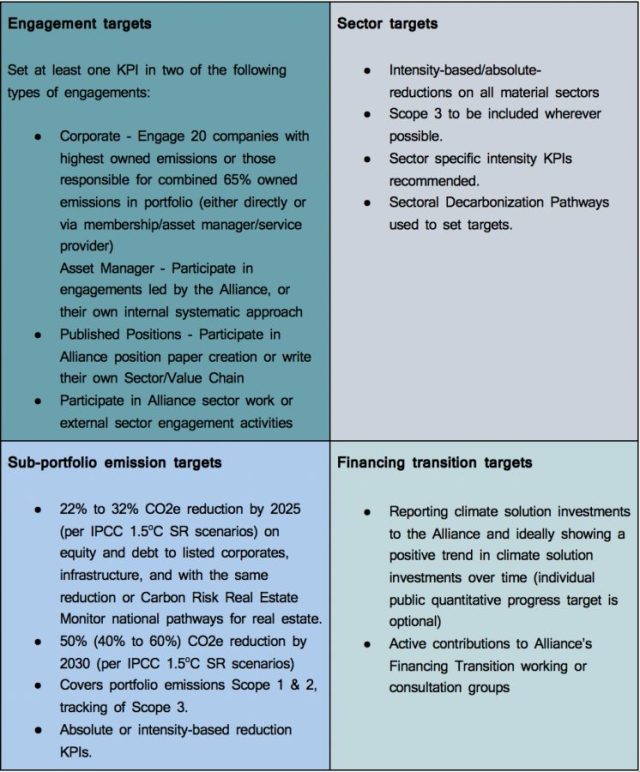

Members set targets in four areas (Table 1). At a minimum, targets must be set in three areas, with engagement targets and reporting on climate solution investments being mandatory. Targets vary in their granularity, as we take a closer look at the commitments of Pension Denmark and Munich Re, the only two members which have disclosed intermediate targets in all four areas. Pension Denmark commits to 20 engagements before 2025, to engage in a minimum of 5 climate change policies and practices with asset managers and to contribute to a minimum of 5 Alliance papers. Munich Re promises to concentrate on and engage with large contributors of financed emissions within the listed equities and corporate bond portfolio.

Table 1 – Intermediate targets for 1.5oC aligned, net zero world by 2050

The Protocol’s focus is on portfolio GHG emissions – Scope 1, 2 and 3. Here is a little reminder of the three scopes as defined by the Alliance:

Scope 1 emissions are direct emissions from your business. This includes emissions from combustion of fuels from furnaces and vehicles, as well as emissions from chemical production. Scope 2 emissions are indirect emissions from the consumption of purchased energy from utility providers that an organisation does not own. This includes electricity, heating, steam and cooling. Scope 3 emissions are all indirect emissions not included in Scope 2. This includes anything that is linked to your organisation’s operations that are not controlled or owned, such as your entire supply chain, business and employee travel, waste generated, purchased materials and goods, office technology, assets, investments, as well as consumer use of your products and services. Basically, everything that isn’t included in scope one and two.

For asset owners, Scope 3 financed emissions is the most important since these represent 95% to 97% of an asset owner’s emissions.

For asset owners, Scope 3 financed emissions is the most important since these represent 95% to 97% of an asset owner’s emissions (Lütkehermöller et al. 2020). For asset owners to track their Scope 3, they have to set and monitor Scope 1, 2 and 3 emissions targets for the companies and assets in their portfolio.

Methodology Innovations Across Asset Classes

Sourcing data for unlisted equity, compared to public companies, is a significant data challenge. The latest target setting protocol sets out the methodology for direct private equity investments. Members must start setting targets in 2023 and cover all new private equity assets by 2025. Private companies make a substantial contribution towards climate change that one cannot afford to disregard, says Alperen Gözlügöl from the Leibniz Institute for Financial Research SAFE (Frankfurt) and Wiseblik Expert. Private companies also buy highly polluting assets from public companies that increasingly divest these assets because of climate action and pressure1. Not only would climate data on private companies help asset owners cover and track this important segment of the economy but also enable a better assessment of Scope 3 emissions of public companies which generally have private companies in their supply chain.

Sovereign debt is a significant asset class for asset owners. The Target Protocol relies on the Partnership for Carbon Accounting Financials (PCAF) methodology for this asset class while keeping a close tab on the ASCOR (Assessing Sovereign Climate-Related Opportunities and Risks) project, especially its work on just transitions and societal considerations.

Across all asset classes, Alliance members shall consider the societal impact of the climate transition, from clients, workers, supply chain partners to local communities, while steering their portfolio towards science-based transition pathways for a net zero economy. Alliance members are asked to focus on emerging markets, which are typically most vulnerable to climate change.

This all sounds like positive steps, right? In theory yes, but the devil is in the details. Once all the industry jargon and science has been sifted through, which can take quite a bit of time in itself, you then have to figure out how to engage with the assets in the portfolio, which for a large asset owner may be complex and global, and then implement a programme of environmental, social, and governance (ESG) data collection in order to create a baseline of GHG emissions and report progress towards intermediate targets annually. This can be a daunting task as data availability, standardisation and transparency vary widely around the world and from company to company. The first wave of internationally comparable sustainability data is only likely to emerge in 2025, assuming the upcoming International Sustainability Standards Board (ISSB) standards become effective in January 2024.

In part 2 of our 3-part series, we will look at how to sift through ESG datasets to determine what is reliable and trustworthy.

about

John Lloyd is Co-Founder and Chief Product Officer of 7 Satya. 7 Satya is on a mission to make sustainability real through the power of radical transparency. Its innovative global location-based intelligence products, that harness the power of Environmental and Social Impact, help firms analyse and assess risks, comply with growing environmental and social impact self-disclosure regulations and develop and monitor sustainable growth strategies. 7 Satya is a forum member of the Taskforce on Nature-related Financial Disclosures (TNFD).

Darshini Waibel is Founder and CEO of Wiseblik, a sustainability talent network, helping the finance sector accelerate its sustainability transition. It deploys world-class, independent sustainability experts on short-term projects, whether advisory, research or training. It boosts the sustainability expertise of corporate decision-makers with its tailored training on sustainability topics. It builds bridges in the ESG tech ecosystem through collaboration with its strategic tech partners.

1 Private Companies: The Missing Link on The Path to Net Zero, European Corporate Governance Institute, March 2022

Published by

investESG

investESG

investESG

investESG